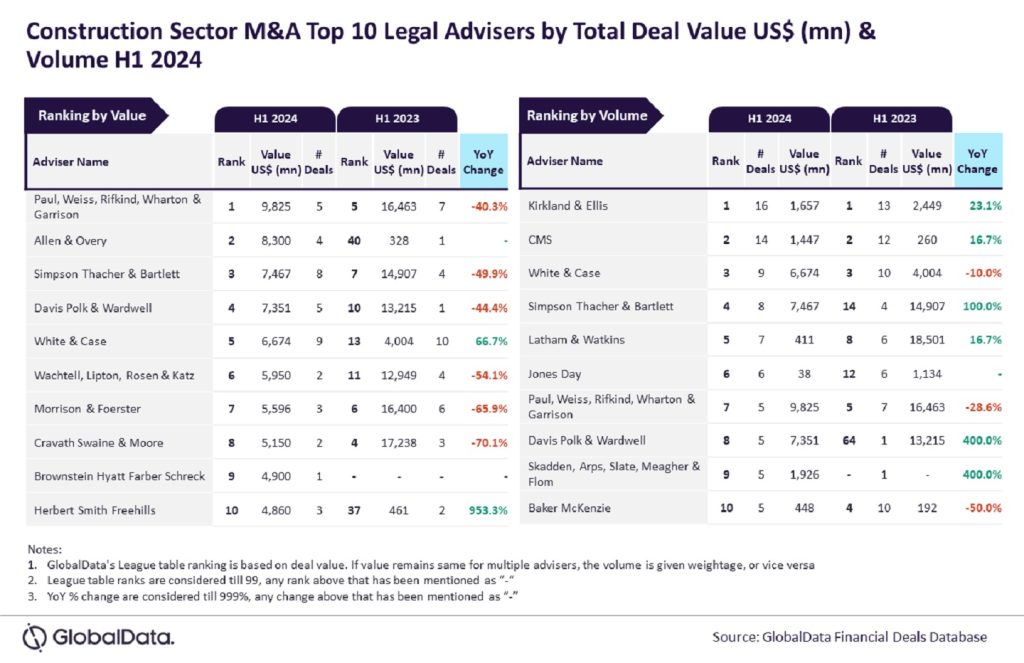

Paul, Weiss, Rifkind, Wharton & Garrison and Kirkland & Ellis have emerged as the leading mergers and acquisitions (M&A) legal advisers in the construction sector by both value and volume in the first half (H1) of financial year 2024, according to leading data and analytics company GlobalData’s latest league table.

GlobalData - the parent of World Construction Network - ranked advisers by the value and volume of M&A deals on which they advised.

According to the company's financial deals database, Paul, Weiss, Rifkind, Wharton & Garrison advised on deals worth a total of $9.8bn, securing the top spot by value in the period.

In terms of volume, meanwhile, Kirkland & Ellis was placed at the top by advising on 16 deals over the period.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the top adviser by volume in H1 2023 and managed to retain its leadership position by this metric in H1 2024 as well. It was among the only two advisers to hit double-digit deal volume during H1 2024.

“Meanwhile, Paul, Weiss, Rifkind, Wharton & Garrison was just shy of touching the $10bn total deal value mark during the review period. It witnessed improvement in its ranking by value from fifth position in H1 2023 to the top spot in H1 2024.”

Allen & Overy claimed the second position in the value category with advisories on deals worth a total of $8.3bn.

Simpson Thacher & Bartlett followed at $7.5bn, Davis Polk & Wardwell at $7.4bn, and White & Case at $6.7bn.

As for deal volume, CMS took the second spot with involvement in 14 deals.

White & Case followed with nine deals while Simpson Thacher & Bartlett and Latham & Watkins advised on eight and seven deals respectively.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.