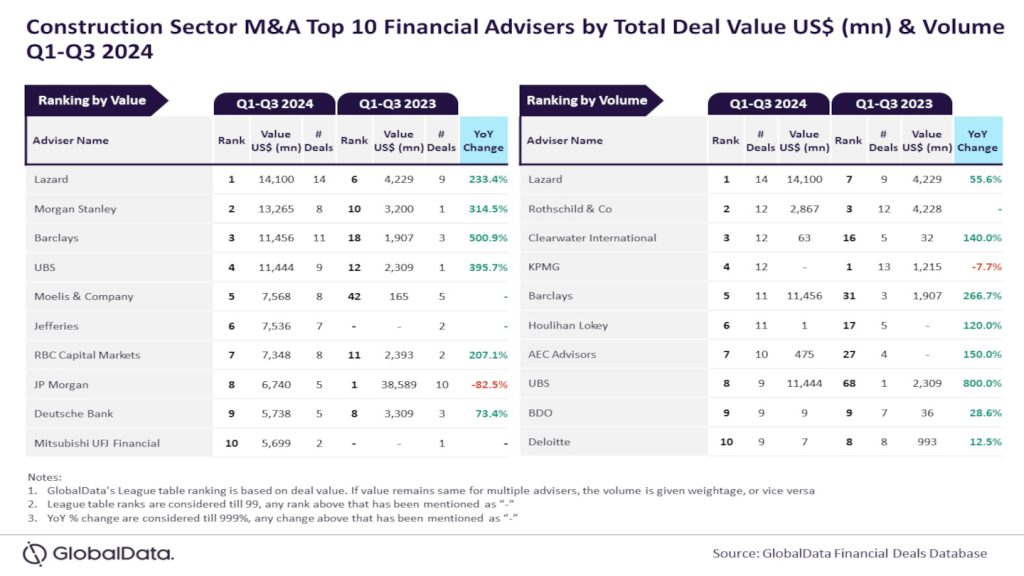

Lazard has emerged as the leading mergers and acquisitions (M&A) financial adviser in the construction sector by both value and volume in the first to third quarter (Q1-Q3) of 2024, as per leading data and analytics company GlobalData’s latest league table.

GlobalData - the parent of World Construction Network - ranked advisers by the value and volume of M&A deals on which they advised during the period.

According to GlobalData’s Deals Database, Lazard advised on 14 deals worth a total of $14.1bn, securing the top spot by value and volume during the period.

GlobalData lead analyst Aurojyoti Bose said: “Lazard witnessed a year-on-year (YoY) improvement in both deal volume and value during Q1-Q3 2024, but the growth was more pronounced in terms of value. It registered a more than three-fold jump in the total value of deals advised by it during Q1-Q3 2024 compared to Q1-Q3 2023.

"Lazard advised on five billion-dollar deals during Q1-Q3 2024. The involvement in these big-ticket deals helped it register a massive jump in terms of value.”

In terms of value, Morgan Stanley ranked second, providing advice on deals totalling $13.3bn, followed by Barclays at $11.5bn, UBS at $11.4bn, and Moelis & Company at $7.6bn.

In terms of deal volume, Rothschild & Co secured the second position with 12 transactions alongside Clearwater International and KPMG while Barclays completed 11 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory businesses, and other reliable sources available via the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure the further robustness of its data, the company also seeks submissions of deals from leading advisers.