Global infrastructure company Ferrovial has reported revenue of €1.87bn ($2.02bn) in the first quarter (Q1) of the financial year 2024 (FY 2024), a 3.5% increase on a like-for-like (LFL) basis from €1.80bn in Q1 FY 2023.

The company noted that this is the first time it is announcing its financial result after being simultaneously listed on the stock exchanges in Spain, the Netherlands, and the US.

Ferrovial’s adjusted earnings before interest and taxes (EBIT) for the quarter between January and March 2024 reached €152m, a substantial 63.2% LFL increase from €94m in the same quarter last year.

Adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) for Q1 FY 2024 was €254m, up 37.6% LFL from €189m in Q1 FY 2023.

This growth was primarily attributed to the strong performance of the company’s toll roads and construction divisions.

The toll roads business reported a 30.1% LFL revenue increase to €277m in Q1 FY 2024, as against €223m in the same period last year. Its adjusted EBITDA also grew by 36.2% to €203m.

Meanwhile, its construction business saw a 0.4% rise in revenue to €1.47bn and ended the quarter with a record order book valued at €15.4bn.

The division's adjusted EBIT surged by 77.1% year-over-year, reaching €32m, with an adjusted EBIT margin of 2.1%.

Ferrovial’s liquidity levels reached €4.90bn in Q1 FY 2024 and a negative consolidated net debt of €667m, excluding infrastructure projects.

The reported quarter's cash consumption was influenced by shareholder remuneration of €254m and investments, including equity contributions to New Terminal One at JFK International Airport and the investment in AGS following its debt facility refinancing.

Noteworthy milestones for the quarter included Ferrovial's agreement to acquire a 24% stake in IRB Infrastructure Trust for €740m.

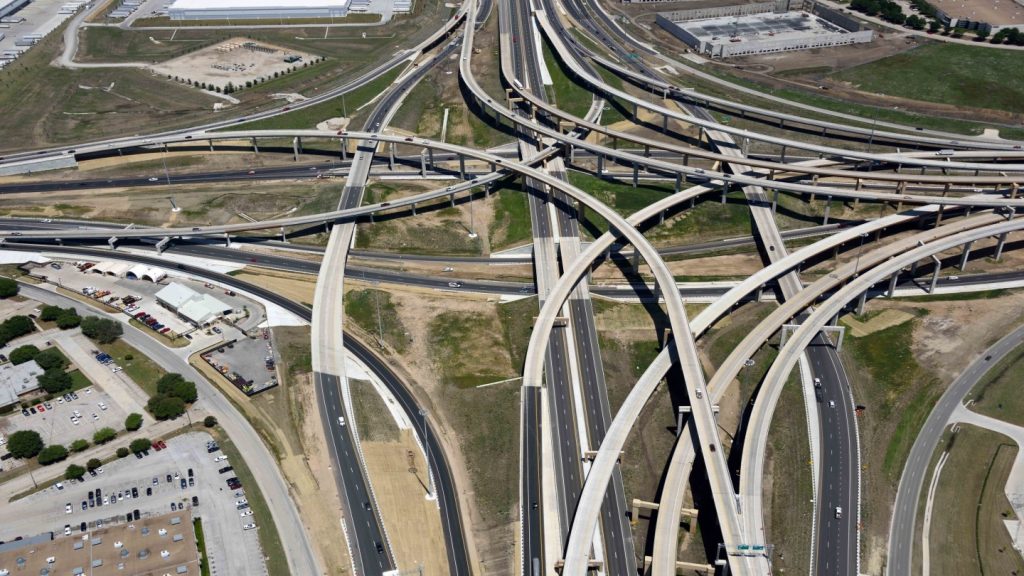

Ferrovial CEO Ignacio Madridejos said: “Once again, the first-quarter results reflect the strong performance of our key infrastructure assets, particularly in the US. Revenues from our Express Lanes grew above inflation and GDP [gross domestic product], demonstrating the value we bring to travellers with faster and less congested highways.

“Listing on the US stock market gives us access to greater financial resources, enabling new development opportunities to continue providing critical infrastructure to communities, helping them to flourish as their populations grow.”