Indonesia’s PT Anugrah Neo Energy Materials and PT Gotion Indonesia Materials, a unit of China's battery manufacturer Gotion High-tech, are set to construct a high-pressure acid leaching (HPAL) plant in Indonesia, reported Reuters, citing the Indonesian Ministry of Industry.

The HPAL battery project agreement has been signed by Anugrah Neo as an investor, with Gotion Indonesia as a strategic partner.

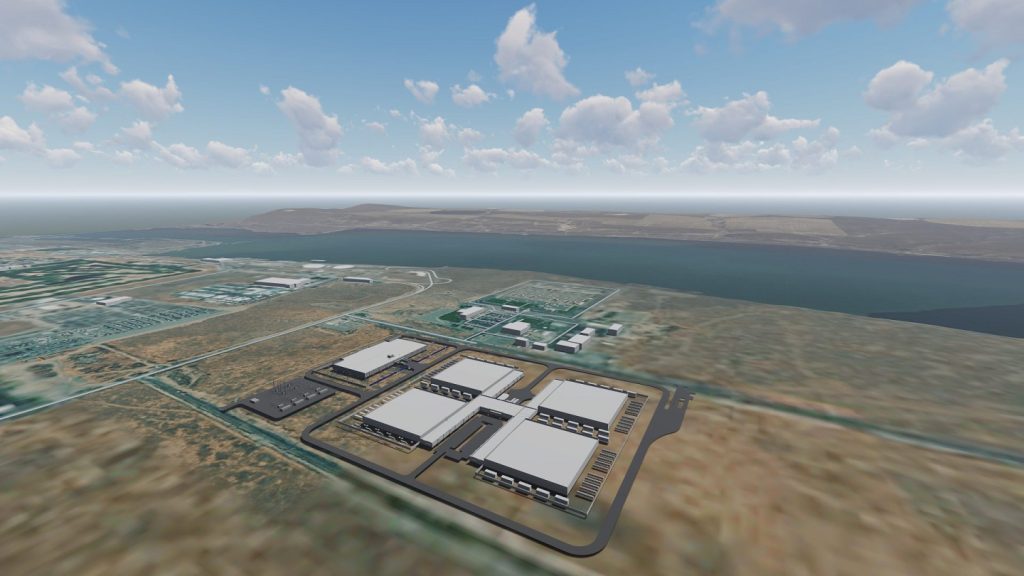

Planned to be built on Sulawesi Island, the proposed plant will feature HPAL technology to enable the conversion of nickel ore or limonite into mixed hydroxide precipitate (MHP). MHP is used in batteries for electric vehicles (EVs).

The facility is predicted to have a production capacity of 120,000 tonnes of nickel in MHP annually.

Indonesia's Minister of Industry Agus Gumiwang Kartasasmita was quoted by VOI as saying: "This collaboration will later become a vertically integrated operation, which combines mining resources with HPAL facilities, to process Ni [nickel] Ore into MHP and Ni/Co [cobalt] Sulfate, which is a cathode precursor material for EV battery production."

Following its ore export ban policy, Indonesia has attracted massive investment to boost its own domestic nickel processing capacity.

However, most of this investment has been allotted to the production of nickel pig iron.

Kartasasmita was cited as saying that nickel export value could surge by 19 times when processed into battery materials.

Kartasasmita elaborated: "Therefore, the government continues to support the growth of domestic industry especially in downstream mineral resources and development of EVs.”