GlobalData, a leading data and analytics company, has revealed its global league tables for top 10 legal advisers in construction sector by value and volume for 2021 in its report, ‘Global and Construction M&A Report Legal Adviser League Tables 2021’.

According to GlobalData’s M&A report, a total of 4,261 merger and acquisition (M&A) deals were announced in the sector during 2021, while deal value for the sector increased by 61.5% from $335.7bn during 2020 to $542bn during 2021.

Top advisers by value and volume

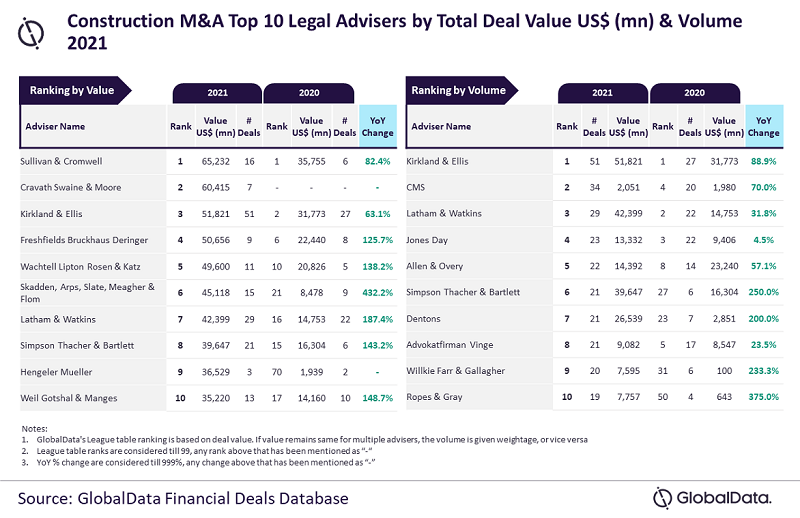

Sullivan & Cromwell and Kirkland & Ellis were the top M&A legal advisers in construction sector for 2021 by value and volume, respectively.

Sullivan & Cromwell advised on 16 deals worth $65.2bn, Kirkland & Ellis advised on 51 deals worth $51.8bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the only advisor to surpass the 50-deal volume mark. Moreover, it managed to advise on some of the big-ticket deals announced in the sector. Consequently, apart from leading by volume, Kirkland & Ellis also occupied the third position by value.

“Meanwhile, Sullivan & Cromwell managed to advise on two mega deals valued more than $10bn, which was pivotal in securing the top position by value for the firm.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCravath Swaine & Moore took the second spot in terms of value with seven deals worth $60.4bn followed by Kirkland & Ellis with 51 deals worth $51.8bn, Freshfields Bruckhaus Deringer with nine deals valued at $50.7bn and Wachtell Lipton Rosen & Katz with 11 deals worth $49.6bn.

CMS secured the second position in terms of volume with 34 deals worth $2.1bn, followed by Latham & Watkins with 29 deals worth $42.4bn, Jones Day with 23 deals worth $13.3bn and Allen & Overy with 22 deals worth $14.4bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.