GlobalData has revealed top 10 financial advisers in construction sector by value and volume for 2021 in its report.

GlobalData, a leading data and analytics company, has revealed its global league tables for top 10 financial advisers in construction sector by value and volume for 2021 in its report, ‘Global and Construction M&A Report Financial Adviser League Tables 2021’.

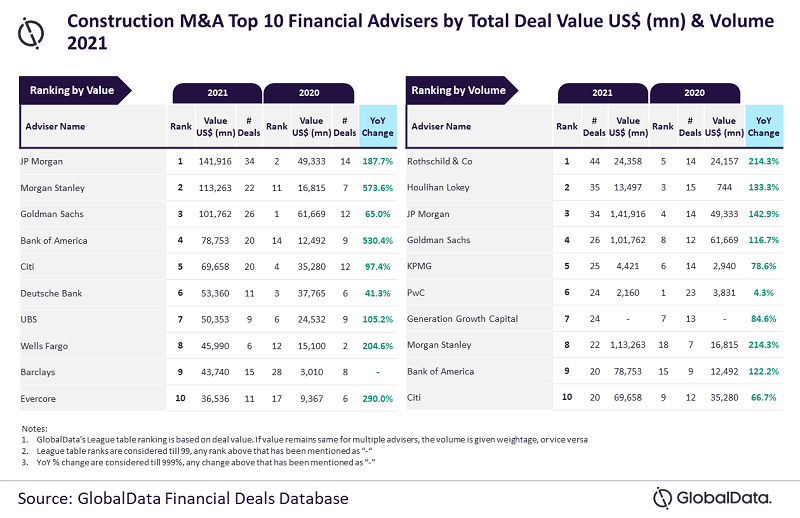

According to GlobalData’s M&A report, a total of 4,261 merger and acquisition (M&A) deals were announced in the sector during 2021, while deal value for the sector increased by 61.5% from $335.7bn during 2020 to $542bn during 2021.

Top advisers by value and volume

JP Morgan and Rothschild & Co were the top M&A financial advisers in construction sector for 2021 by value and volume, respectively.

JP Morgan advised on 34 deals worth $141.9bn, while Rothschild & Co advised on 44 deals worth $24.4bn.

GlobalData lead analyst Aurojyoti Bose said: “Both Rothschild & Co and JP Morgan are clear winners in terms of volume and value, respectively. While Rothschild & Co was the only firm to advise on more than 40 deals during 2021, JP Morgan was also much ahead of its peers by value terms – the only advisor with deal value exceeding $140bn. Meanwhile, JP Morgan also managed to occupy the third position by volume.”

Morgan Stanley took the second spot in terms of value with 22 deals worth $113.3bn followed by Goldman Sachs with 26 deals valued at $101.8bn, Bank of America with 20 deals worth $78.8bn and Citi with 20 deals worth $69.7bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHoulihan Lokey got the second place in terms of volume with 35 deals worth $13.5bn followed by JP Morgan and Goldman Sachs. KPMG secured the fifth place by volume with 25 deals worth $4.4bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.