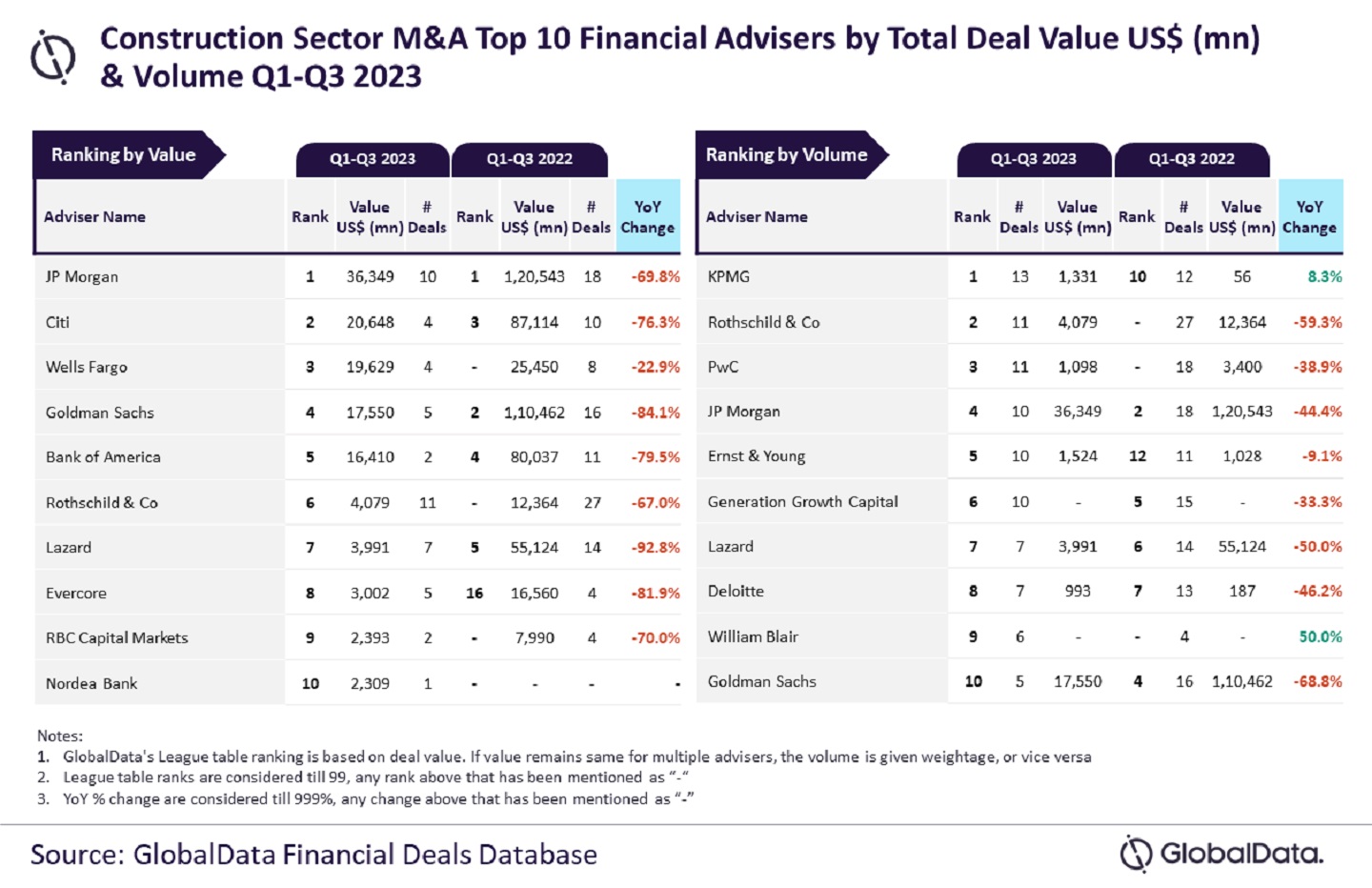

JP Morgan and KPMG emerged as the top mergers and acquisitions (M&A) financial advisers in the construction sector in terms of value and volume, respectively, during the first three quarters (Q1-Q3) of 2023, according to the latest league table released by GlobalData.

GlobalData, the parent company of World Construction Network, ranks advisers in terms of the value and volume of M&A deals on which they advised.

According to the data and analytics company’s Financial Deals Database, JP Morgan took the lead in the value table by advising on a total of $36.3bn worth of deals while KPMG led the volume table by advising on a total of 13 deals.

GlobalData lead analyst Aurojyoti Bose said: “While a majority of the top ten advisers by volume witnessed a decline in the total number of deals advised by them during Q1-Q3 2023 compared to Q1-Q3 2022, KPMG stood as an exception and registered growth. It also saw a significant jump in its ranking from the tenth position by volume in Q1-Q3 2022 to the top spot by this metric in Q1-Q3 2022.

“Meanwhile, JP Morgan was the top adviser by value in Q1-Q3 2022 and managed to retain its leadership position by this metric in Q1-Q3 2023 as well. It advised on five billion-dollar deals that also included two mega deals valued more than $10bn during Q1-Q3 2023. Involvement in such big-ticket deals helped JP Morgan lead the chart by value.”

Citi ranked second in terms of value by advising on deals worth a total of $20.6bn, followed by Wells Fargo with $19.6bn, Goldman Sachs with $17.6bn, and Bank of America with $16.4bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRothschild & Co took the second spot in terms of volume with 11 deals, equalled by PwC with 11 deals, followed by JP Morgan with ten deals, and Ernst & Young also with ten deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory businesses, and other reliable sources available via the secondary domain. A dedicated team of analysts monitors all of these sources to gather in-depth details for each deal, including adviser names.

To ensure the further robustness of its data, the company also seeks submissions of deals from leading advisers.