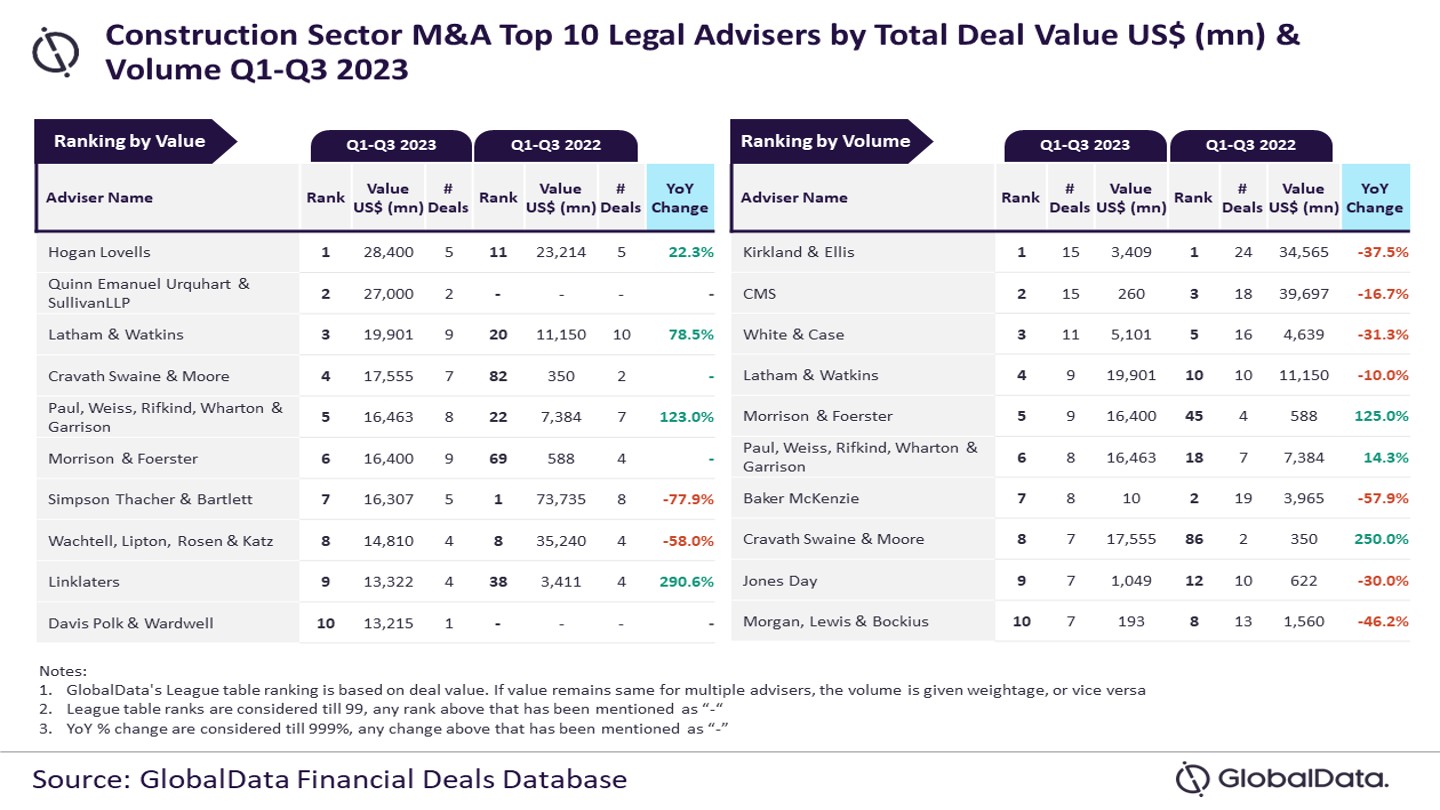

Hogan Lovells and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in the construction sector by value and volume, respectively during the first to third quarter (Q1-Q3) of 2023, according to GlobalData’s latest league table.

The data and analytics company ranked advisers by the value and volume of M&A deals on which they advised.

According to its Financial Deals Database, GlobalData found that Hogan was the leading adviser measured in terms of value by advising on deals worth a total of $28.4bn during the period.

Meanwhile, Kirkland & Ellis achieved the top spot when measured by the number of transactions, after offering advice on a total of 15 deals.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the top adviser by volume during Q1-Q3 2022 and managed to retain its leadership position by this metric during Q1-Q3 2023 as well.

“Meanwhile, Hogan Lovells experienced a jump in its ranking by this metric in Q1-Q3 2023 compared to Q1-Q2 2022. The total value of deals advised by it jumped by 22.3% in the first three quarters of 2023 compared to the same period in 2022 due to its involvement in some high-value transactions. Hogan Lovells advised on three billion-dollar deals, of which two were mega deals valued more than $10bn.”

Quinn Emanuel Urquhart & Sullivan came second in terms of value by advising on deals worth $27bn, followed by Latham & Watkins with $19.9bn, Cravath Swaine & Moore with $17.5bn, and Paul, Weiss, Rifkind, Wharton & Garrison with $16.4bn.

Runners-up in terms of volume were CMS with 15 deals, White & Case with 11 deals, and Latham & Watkins and Morrison & Foerster, both with nine deals each.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.