The construction industry continues to be a hotbed of innovation, with activity driven by an increased focus on workplace safety, circular construction and environmental sustainability, and the growing importance of technologies such as robotics and the Internet of Things (IoT). In the last three years alone, there have been over 248,000 patents filed and granted in the construction industry, according to GlobalData’s report on Environmental sustainability in Construction: Rainwater harvesting systems. Buy the report here.

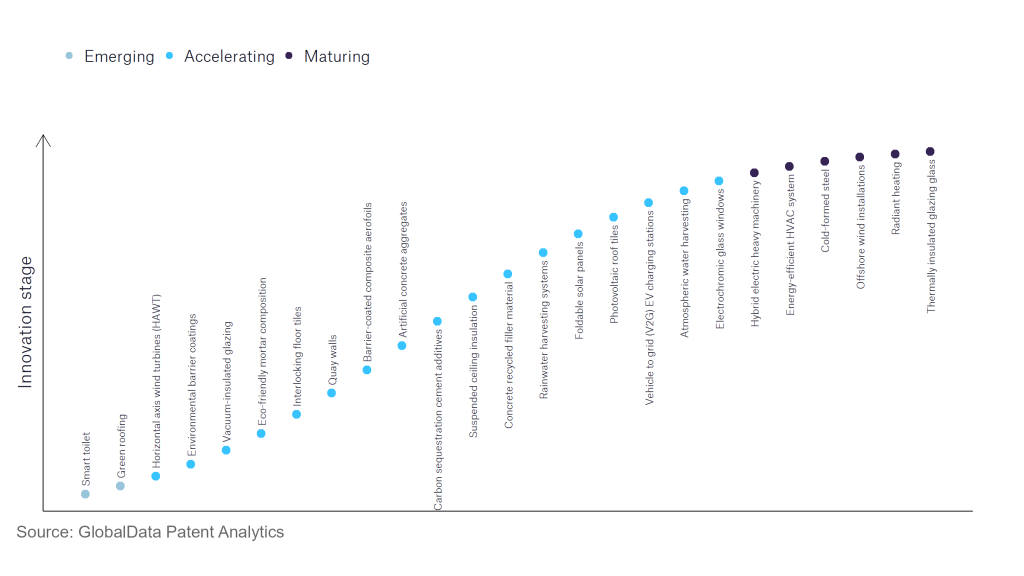

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the construction industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the construction industry using innovation intensity models built on over 179,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, green roofing is a disruptive technology that is in the early stages of application and should be tracked closely. HAWT wind turbines, environmental barrier coatings, and vacuum-insulated glazing are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are hybrid electric heavy machinery and energy-efficient HVAC system, which are now well established in the industry.

Innovation S-curve for environmental sustainability in the construction industry

Rainwater harvesting systems are a key innovation area in environmental sustainability

Rainwater harvesting is an environmentally sustainable and efficient source of water. The three most common methods to harvest rainwater are direct pumped, indirect pumped and indirect gravity systems.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 30+ companies, spanning technology vendors, established construction companies, and up-and-coming start-ups engaged in the development and application of rainwater harvesting systems.

Key players in rainwater harvesting systems – a disruptive innovation in the construction industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to rainwater harvesting systems

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Siemens | 39 | Unlock Company Profile |

| Watergen | 25 | Unlock Company Profile |

| Zero Mass Water | 23 | Unlock Company Profile |

| State-owned Assets Supervision and Administration Commission of the State Council | 21 | Unlock Company Profile |

| Berkshire Hathaway | 20 | Unlock Company Profile |

| Lta | 20 | Unlock Company Profile |

| China State Construction Engineering | 19 | Unlock Company Profile |

| Totetu Manufacturing | 19 | Unlock Company Profile |

| Kobe Steel | 16 | Unlock Company Profile |

| Ford Motor | 16 | Unlock Company Profile |

| Fresenius | 13 | Unlock Company Profile |

| POSCO Holdings | 13 | Unlock Company Profile |

| Dongguan Lianzhou Intellectual Property Operation Management | 13 | Unlock Company Profile |

| Teijin | 12 | Unlock Company Profile |

| Genesis Systems | 11 | Unlock Company Profile |

| Greif | 11 | Unlock Company Profile |

| Guizhou Transportation Planning Survey and Design Academe | 10 | Unlock Company Profile |

| South East Water | 9 | Unlock Company Profile |

| Orbia Advance | 9 | Unlock Company Profile |

| Power Construction Corporation of China | 8 | Unlock Company Profile |

| Raytheon Technologies | 8 | Unlock Company Profile |

| Kotobuki Realty | 8 | Unlock Company Profile |

| KSB | 7 | Unlock Company Profile |

| State Grid Corporation of China | 7 | Unlock Company Profile |

| Quikrete Holdings | 7 | Unlock Company Profile |

| Dutch Rainmaker | 7 | Unlock Company Profile |

| Arup Group | 7 | Unlock Company Profile |

| Hefei Hongrun Environmental Protection Technology | 7 | Unlock Company Profile |

| Honeywell International | 6 | Unlock Company Profile |

| China Railway Construction | 6 | Unlock Company Profile |

| Agilitas Partners LLP | 6 | Unlock Company Profile |

| Deere & Co | 6 | Unlock Company Profile |

| Frankische Rohrwerke Gebr Kirchner | 6 | Unlock Company Profile |

| Suzhou Gold Mantis Construction Decoration | 5 | Unlock Company Profile |

| BASF | 5 | Unlock Company Profile |

| Rainmaker Worldwide | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Leading companies in the development of rainwater harvesting systems include China’s State-owned Assets Supervision and Administration Commission of the State Council (SASAC). Key patents filed by SASAC in the space include an environment-friendly rainwater collecting and utilising device for buildings, comprising a rainwater collection tank with an arc-shaped cover plate mounted on the top of the rainwater collection tank and a generator within the collecting pipe. The gravitational potential energy generated by rainwater dropping drives the generator wheel to rotate to generate electricity, while a rainwater filter installed on the pipeline of the collecting pipe purifies and filters the rainwater.

In terms of application diversity, leading innovators in the development of rainwater harvesting systems include Watergen, a developer of atmospheric water generator systems, and Honeywell International, an engineering and technology company.

In terms of geographic reach, leading companies in the space include KSB, a German multinational manufacturer of pumps, valves and related services, and Teijin, a manufacturer of carbon fibre products, synthetic fibre, and water purification systems.

To further understand the key themes and technologies disrupting the construction industry, access GlobalData’s latest thematic research report on Construction.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.