The construction industry continues to be a hotbed of innovation, with activity driven by an increased focus on environmental sustainability and workplace safety, and the growing importance of technologies such as the Internet of Things (IoT) and robotics. In the last three years alone, there have been over 248,000 patents filed and granted in the construction industry, according to GlobalData’s report on Environmental Sustainability in Construction: Artificial concrete aggregates. Buy the report here.

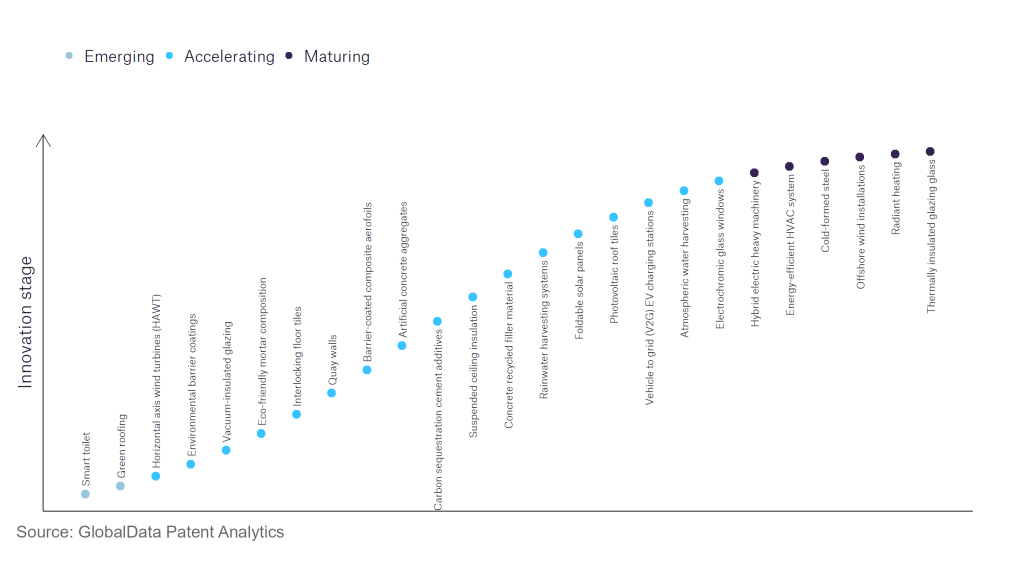

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the construction industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the construction industry using innovation intensity models built on over 179,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, smart toilets and green roofing are the disruptive technologies that are in the early stages of application and should be tracked closely. HAWT wind turbines, environmental barrier coatings, and vacuum-insulated glazing are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are hybrid electric heavy machinery and energy-efficient HVAC system, which are now well established in the industry.

Innovation S-curve for environmental sustainability in the construction industry

Artificial concrete aggregates is a key innovation area in environmental sustainability

The impact of the built environment on the planet is huge, with the worldwide cement industry responsible for between 4% and 8% of global CO2 emissions. To minimise negative environmental impacts, companies must design out carbon-intensive and polluting materials. Artificial aggregates mainly comprise waste materials and by-products of industrial processes such as clinkers and ash. With the depletion of natural resources, there is a growing focus on artificial aggregates, but challenges remain in overcoming limitations in strength and performance.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 80+ companies, spanning technology vendors, established construction companies, and up-and-coming start-ups engaged in the development and application of artificial concrete aggregates.

Key players in artificial concrete aggregates – a disruptive innovation in the construction industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to artificial concrete aggregates

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Halliburton | 202 | Unlock Company Profile |

| Gebr Knauf | 190 | Unlock Company Profile |

| Holcim | 85 | Unlock Company Profile |

| Taiheiyo Cement | 70 | Unlock Company Profile |

| Sumitomo Osaka Cement | 67 | Unlock Company Profile |

| Compagnie de Saint-Gobain | 49 | Unlock Company Profile |

| Schlumberger | 49 | Unlock Company Profile |

| Nichiha | 45 | Unlock Company Profile |

| BASF | 44 | Unlock Company Profile |

| POSCO Holdings | 41 | Unlock Company Profile |

| Omya International | 40 | Unlock Company Profile |

| HeidelbergCement | 35 | Unlock Company Profile |

| James Hardie Industries | 35 | Unlock Company Profile |

| ShreddedTire | 32 | Unlock Company Profile |

| Geopolymer Solutions | 29 | Unlock Company Profile |

| Sumitomo Mitsui Construction | 27 | Unlock Company Profile |

| Albemarle | 26 | Unlock Company Profile |

| Boral | 25 | Unlock Company Profile |

| CelluComp | 24 | Unlock Company Profile |

| China State Construction Engineering | 21 | Unlock Company Profile |

| Yara International | 21 | Unlock Company Profile |

| Sika | 21 | Unlock Company Profile |

| Weyerhaeuser | 21 | Unlock Company Profile |

| State-owned Assets Supervision and Administration Commission of the State Council | 20 | Unlock Company Profile |

| Kemira | 18 | Unlock Company Profile |

| Ruredil | 18 | Unlock Company Profile |

| Far Eastone Telecommunications | 17 | Unlock Company Profile |

| Denka | 17 | Unlock Company Profile |

| Paper Excellence | 17 | Unlock Company Profile |

| Berkshire Hathaway | 15 | Unlock Company Profile |

| Daewoo Engineering & Construction | 15 | Unlock Company Profile |

| Active Minerals International | 15 | Unlock Company Profile |

| JFE Holdings | 15 | Unlock Company Profile |

| Criaterra Innovations | 14 | Unlock Company Profile |

| Mitsubishi Heavy Industries | 14 | Unlock Company Profile |

| Mitsui E&S Holdings | 14 | Unlock Company Profile |

| CEA | 14 | Unlock Company Profile |

| Etex | 13 | Unlock Company Profile |

| Adaptavate | 13 | Unlock Company Profile |

| Solvay | 13 | Unlock Company Profile |

| Dow | 13 | Unlock Company Profile |

| Hanil Cement | 12 | Unlock Company Profile |

| Samsung C&T | 12 | Unlock Company Profile |

| Parjointco | 11 | Unlock Company Profile |

| China Communications Construction Group | 10 | Unlock Company Profile |

| Mitsubishi Materials | 10 | Unlock Company Profile |

| Hatch | 10 | Unlock Company Profile |

| UPM-Kymmene | 10 | Unlock Company Profile |

| Japan Science and Technology Agency | 10 | Unlock Company Profile |

| Pavimentos De Tudela | 10 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Knauff is one of the leading filers in artificial concrete aggregates. The company, which is one of the world’s leading manufacturers of construction materials, has filed a method of making a lightweight cementitious binder composition with improved compressive strength for products such as cementitious panels. The method mixes fly ash, alkali metal salt of citric acid, alkali metal silicate, foaming agent for entraining air, water and in the preferred embodiment a foam stabilising agent. Other key patent filers in the artificial concrete aggregates space include Halliburton, Holcim, Taiheiyo Cement, Sumitomo Osaka Cement, and Compagnie de Saint-Gobain.

In terms of application diversity, CelluComp is among the leaders in the pack, along with Shredded Tire. By means of geographic reach, Solvay held the top position, followed by Etex and Yara International.

To further understand the key themes and technologies disrupting the construction industry, access GlobalData’s latest thematic research reports on Construction.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.