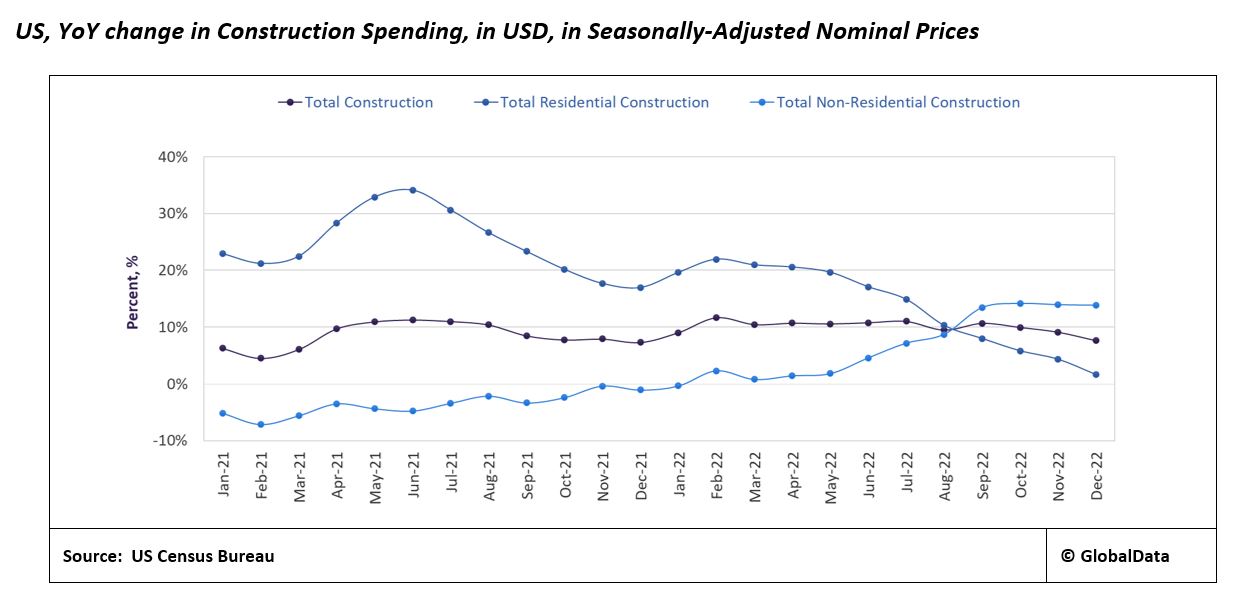

Newly released construction spending data has shown that the residential market continues to drag down construction industry growth. Recently released data from the US Census Bureau for December 2022 shows that, in seasonally adjusted nominal terms, the industry contracted 0.3% from November 2022 and increased 7.7% compared to the previous year. The residential construction market registered just a 1.6% year-on-year (YoY) growth and non-residential construction spending registered a 13.8% YoY growth.

Overall construction spending growth has been fairly stable over the past year, for the most part maintaining double-digit growth throughout the year. However, construction spending dipped below 10% in October 2022, largely driven by the drop-off in the residential sector. The residential sector’s share of the construction market has dropped over recent months; in August 2022 the residential sector made up 50.7% of the construction market and its share fell to 47.9% in December 2022, as residential spending growth has significantly decelerated from its June 2021 peak of 32.1% YoY. The pace of growth in non-residential spending overtook residential spending in September 2022, after recovering strongly from a contraction during 2021.

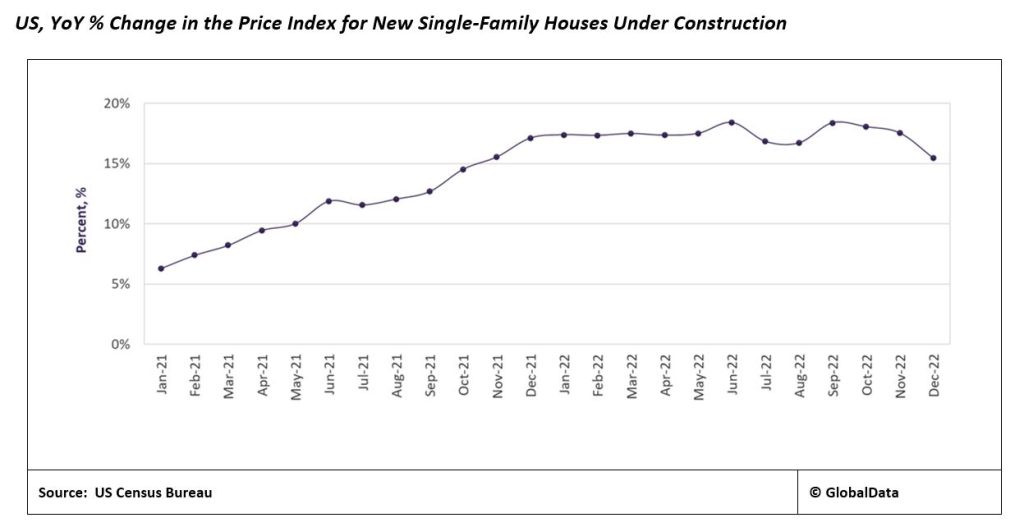

It is important to note that these figures are in nominal terms and do not account for key input cost increases, which have been particularly high over the past year. In real output terms (excluding the impact of price rises), the construction industry contracted 9.6% YoY in Q3 2022 following three consecutive contractions, according to data published by the US Bureau of Economic Analysis. The price index for new, single-family housing under construction represents the changes in construction costs, such as materials and labour. The price index increases have accelerated since June 2020, surpassing the 10% mark in June 2021, and registering a 15.4% YoY increase in December 2022.

There are signs inflationary pressure has started to ease; the rate of increase in the consumer price index (CPI) fell to 6.5% in December from its August 2022 peak of 9.1%, and the pace of increase in the price index for new, single-family housing has slowed in recent months. Commodity prices have dropped off in recent months, largely as a result of expectations that the global economy is likely to enter a recession due to intensive monetary tightening. The Federal Reserve (Fed) has persisted in its effort to tame inflation by raising interest rates for the seventh consecutive time in the past year by 0.5 percentage points to 4.5% in mid-December 2022, and further rate increases are expected by the Fed in 2023, although increases are slowing.

The residential market is taking the brunt of the increases in interest rates as mortgage rates tipped over 7% in late October 2022, and housing demand is plummeting. The housing market is now on a downward trajectory; this trend is evident in the most recent permit data, which in December 2022 fell 1.6% month-on-month (MoM) and 27.4% from the same point the previous year. Similarly, during the same period, the most recent housing starts data showed a 1.4% fall from the previous month and a 21.8% drop from the previous year. Furthermore, housing permits are lagging behind housing starts, which shows that new activity is drying up. According to the National Association of Home Builders, the NAHB/Wells Fargo Housing Market Index, which measures confidence among single-family home builders, fell for the 13th consecutive month in December 2022 and is now level with confidence at the peak of the pandemic.

Although construction in the manufacturing sector contracted in December by 2.2% from the previous month, the sector has performed strongly over the year, increasing by 42.6%. This is largely driven by ‘re-shoring’ and increased dynamism to move technology supply chains away from Asia and China in particular. Industrial construction will be further increased over the longer term by the CHIPS and Science Act (which will put approximately $80 billion in semi-conductor manufacturing), and the Inflation Reduction Act (IRA, which will put $369 billion into energy and security and climate change initiatives over the next ten years, including electric vehicle manufacturing subsidies, and renewable energy production, among others). However, spending under these programs will likely take time to feed into actual construction activity on the ground..

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHighway and street construction spending is starting to see an upturn, growing by 1.1% in December compared to November, and 14.4% over the year, with signs that funding under the $1.2 trillion Infrastructure Investment and Jobs Act (IIJA) signed in late 2021 is starting to feed through to project development. The Department of Transportation recently allocated $76.7 billion to all states, with $53.7 billion allocated to roads, bridges, and major projects, and will likely drive further growth in this sector. In addition, transportation, water, and sewage construction spending, which saw contractions in December, will likely see an uptick in activity over the coming year.

Power construction spending has in particular performed poorly, contracting by 7.5% YoY in December and growing a minimal 0.3% over the month, which is largely due to lagging investment. However, future growth is expected to be improved by federal spending, with 63.6% of the IRA and 15.2% of the IIJA allocated toward power production and infrastructure development.