On 12 March 2025, South Africa’s Minister of Finance Enoch Godongwana delivered the 2025 National Budget for financial year 2025-26 (FY25-26, 1 April 2025 to 31 March 2026). Godongwana presented the government’s spending priorities after the budget was postponed by three weeks following internal disagreements regarding a proposed VAT increase. The 2025 budget hopes to demonstrate the government’s commitment to fostering sustainable economic growth, stabilising public finances, and assisting low-income and vulnerable households. The budget aims to support the government’s economic growth strategy, focusing on enhancing living standards amid global uncertainty, trade disputes, and financial vulnerabilities. The South African government will strive to maintain macroeconomic stability, reduce living costs, boost investment, and implement reforms for a dynamic economy. Additionally, efforts will be made to strengthen state capabilities and promote growth-driven public infrastructure investment.

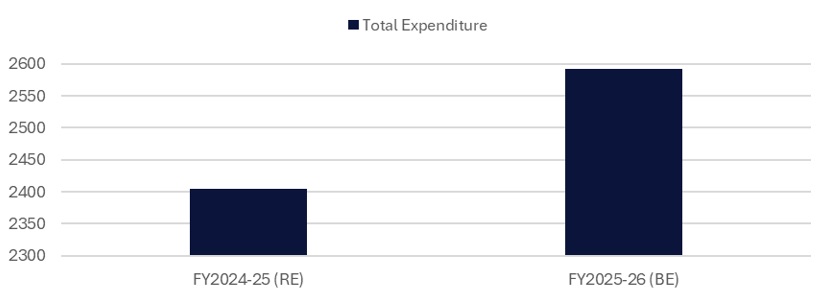

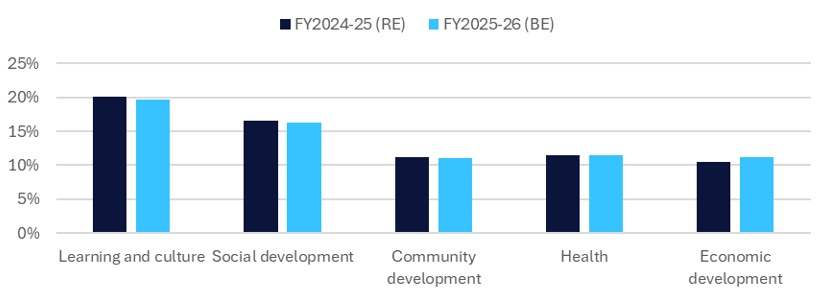

The new budget includes expenditure worth R2.6trn in FY25-26, marking a 7.8% growth compared to the expenditure of R2.4trn in the revised estimates (REs) of the FY24-25 budget. By sector, R508.7bn will be allocated towards learning and culture in FY25-26 while R422.3bn has been made available for social development. Additionally, the healthcare sector will receive R298.9bn in funding, there will be R289.8bn made available for economic development, and R286.6bn for community development.

The FY25 budget is expected to foster growth in the beleaguered construction sector, particularly in infrastructure projects. As part of the budget, the government has allocated R1trn to fund public infrastructure spending over the next three years. This allocation will be directed towards three main sectors: transport and logistics (R402bn), energy infrastructure (R219.2bn), and water and sanitation (R156.3bn). Furthermore, the government has allocated R100bn to the South African National Roads Agency for national road projects and R32bn to improve water supply systems. This includes the uMkhomazi Water Scheme, which aims to address the country’s water scarcity challenges. These infrastructure initiatives are designed to stimulate economic activity, create jobs, and improve public services across the nation.

The government has also allocated significant funds to energy development, focusing on transitioning to renewable energy sources and supporting the national power utility, Eskom. The government reduced Eskom’s debt relief from R70bn, which was initially announced in the FY23 budget, to R50bn, due to the utility’s improved financial situation. Additionally, a R4bn loan from the French Development Bank will support the implementation of the country’s ‘Just Energy Transition Investment Plan’ in 2025-26. Another focus area is electric vehicles (EVs) and related technologies, with the government allocating R1bn to promote local EV production, with the aim of attracting major automotive manufacturers and stimulating private sector investment. This initiative aims to transition the domestic automotive industry from primarily producing internal combustion-engine vehicles to a mix that includes electric vehicles by 2035.

The budget also covers the country’s current economic status, growth projections for the forecast period, and the country’s high debt servicing costs, which the government looks to mitigate against through a proposed VAT alongside sin tax hikes. The government projects a budget deficit of 4.7% of gross domestic product (GDP) in FY25, down from 4.4% in FY24, thus reflecting its commitment to fiscal consolidation. Gross loan debt is expected to stabilise at 76.2% of GDP in FY25. To address the fiscal pressures, reduce the budget deficit and debt servicing costs, and generate additional revenue to fund essential public services, the government will increase VAT by 0.5% in the FY25 budget. The revised rate will be effective from May 2025, with another 0.5% rise expected in April 2026, bringing the rate to 16%. This increase is lower than the 2% hike proposed in the previous iteration of the budget in February 2025. Additionally, excise duties on alcohol, tobacco, and vaping products will rise by up to 6.8% from April 2025. To compensate for the lower-than-expected VAT revenue, the National Treasury did not adjust personal income tax brackets for inflation. As a result, many individuals, particularly those with fixed salaries, will be left with reduced take-home pay. The hike in VAT is expected to put upward pressure on household inflation, especially for lower-income groups. To combat this, the government will extend its zero-rated food items policy to mitigate the impact on the vulnerable population. Additionally, the government has also proposed an extension of the Social Relief of Distress grant, which was initiated in 2020, and will now continue until March 2026. The grant, currently set at R370 per month in the FY25 budget, helps over ten million people and aims to ease the financial burden on vulnerable households. The FY25 budget has allocated R35.2bn towards the scheme. According to budget estimates, the country’s GDP will grow by 1.9% in 2025, before recording an average growth of 1.8% during the 2025-27 period. This continued recovery is expected to be supported by improved investor confidence, a stable electricity supply, and a lower interest rate environment.

Overall, South Africa’s 2025 budget reinforces the government’s focus on stabilising public debt, with a strategic aim to reduce the budget deficit while addressing inflationary pressures and global uncertainties. The budget includes significant investments in transportation, energy, and manufacturing, which aim to sustain long-term growth and ensure economic stability for both businesses and individuals over the forecast period.