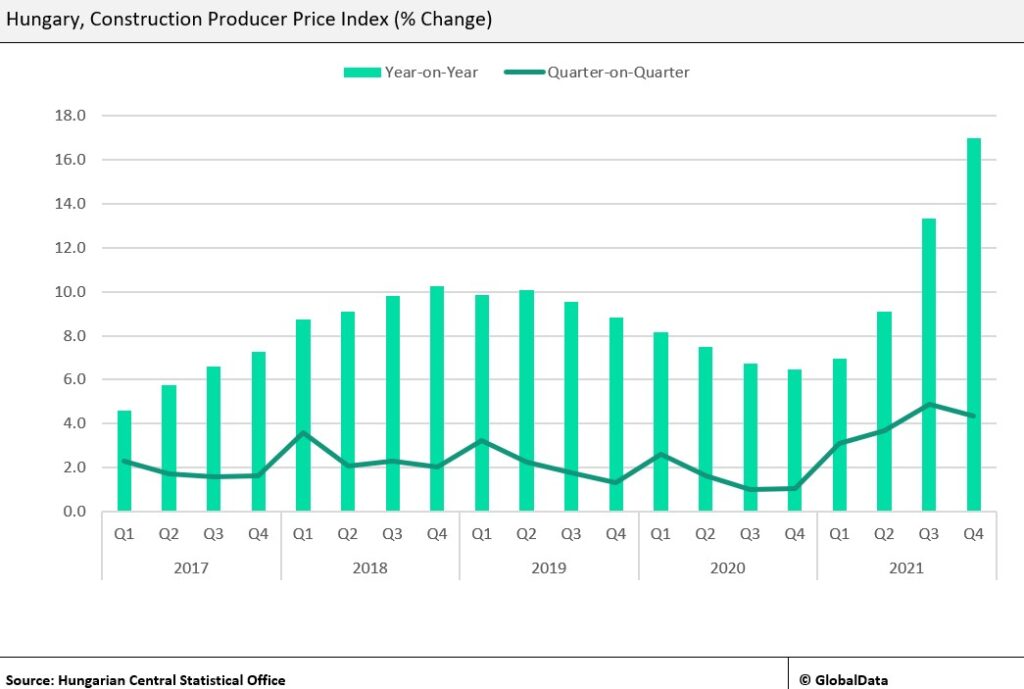

The Construction Producer Price Index (CPPI) in Hungary soared in the second half of 2021, with the latest data from the Hungarian Central Statistical Office showing a year-on-year (YoY) increase of 17% in Q4, preceded by YoY increases of 13.3% in Q3 and 9.1% in Q2. Prior to this surge in the CPPI, construction producer prices were growing at a gradually decreasing rate from their previous peak in Q4 2018 when prices were 10.3% higher than they were in the year-earlier period. The current spike in prices reflects the challenges faced by the construction industry globally amid tight labour and commodity markets exacerbated by supply chain disruptions.

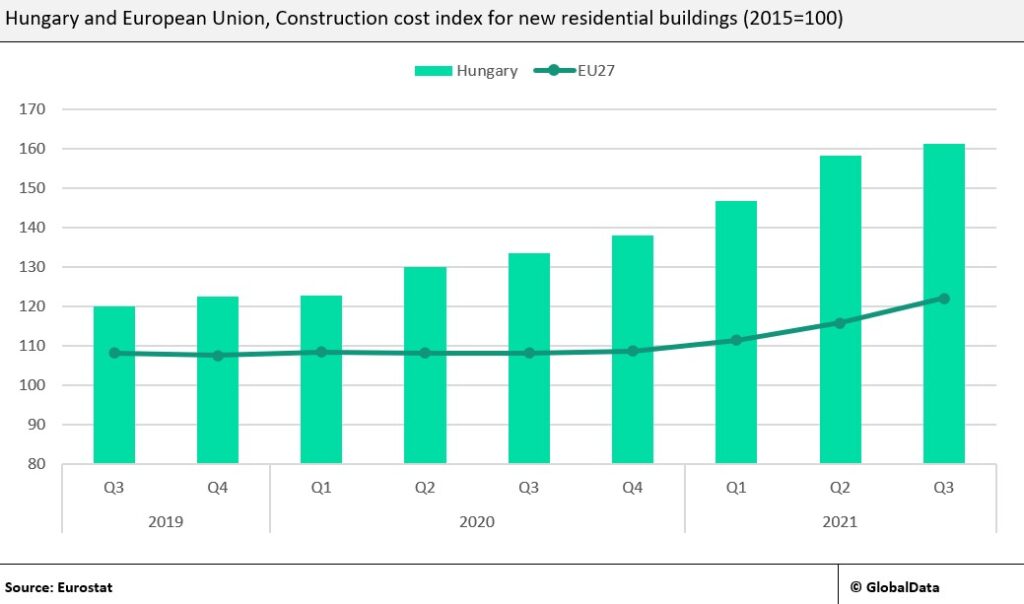

Construction input costs rose significantly in 2021, leading contractors to pass on higher costs to buyers, causing the spike in CPPI. Although these rising costs are a global issue, the impact on Hungary has been particularly adverse compared to its close neighbours. Data from Eurostat shows that while the input costs of constructing new residential buildings rose by 12.3% across the EU on average from 2020 to the end of Q3, costs in Hungary increased by 16.8%. Current market conditions are exacerbating an upward trend in input prices in Hungary in which it has seen consecutive quarter-on-quarter price rises since 2020 Q2, largely due to increases in concrete and steel prices.

The construction industry faces rising costs of both materials and labour due to increased global demand following the lifting of Covid restrictions in many countries while the economic effects of the pandemic have caused bottlenecks in global supply chains. One significant cause of higher input costs is the hike in energy prices reflected in tight oil and gas markets, which in turn, increases the operating cost of construction sites whilst also pushing up prices for energy-intensive materials such as bricks and cement. In addition, the post-pandemic tightness in labour markets has had a compounding effect on overall construction input prices, pushing up producer prices further.

In addition to global market failures, political and demographic conditions are likely to further amplify rising construction producer prices in Hungary. Prime Minister Viktor Orban, leader of the right-wing nationalist Fidesz party, openly opposes immigration and rejects the imposition of the EU’s migrant quota in favour of protecting ethnic and religious heritage, despite the country’s shrinking and ageing population. The effect of this policy is likely to cause a further tightening of the labour market, which will increase construction input costs and put upwards pressure on the CPPI. A policy reversal could help to dampen the adverse effects felt in Hungary, which could be enacted if the Fidesz party are defeated in the April 2022 election by a coalition of parties united against Orban’s ‘illiberal democratic’ rule.

Overall, construction output has not yet seen a significant slowdown from rising input prices as the post-pandemic construction boom continues. However, prices are likely to rise further in 2022, increasing pressure on the industry throughout the year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData