Growth in Singapore’s construction industry continued its upward trend during 2023, with the industry’s value add rising from 6.7% in 2022 to 7.7% according to the advanced estimates of the Ministry of Trade and Industry (MTI). As part of the 2023 budget, the government allocated S$9.4 billion ($6.8 billion) for the transport sector, S$3.9 billion for trade and industry, S$1.4 billion for the healthcare sector and S$450 million for the education sector.

Construction milestones achieved in 2023 included the commencement of construction on the Jurong Region Line, phase one of the Cross Island Line and the extension of the Cross Island Line – Punggol projects.

The industry’s growth is expected to slow to 3.3% in 2024, partly due to soft external demand amid an uncertain global environment. According to the Department of Statistics (DOS), Singapore’s benchmark non-oil domestic exports shrank by 3.4% year-on-year (YoY) in October 2023, marking the 13th straight month of contraction, as electronics and non-electronics shipments continued to fall. However, the anticipated turn-around in global electronics demand and a normalisation of inventory levels is likely to support a gradual rebound in trade in 2024.

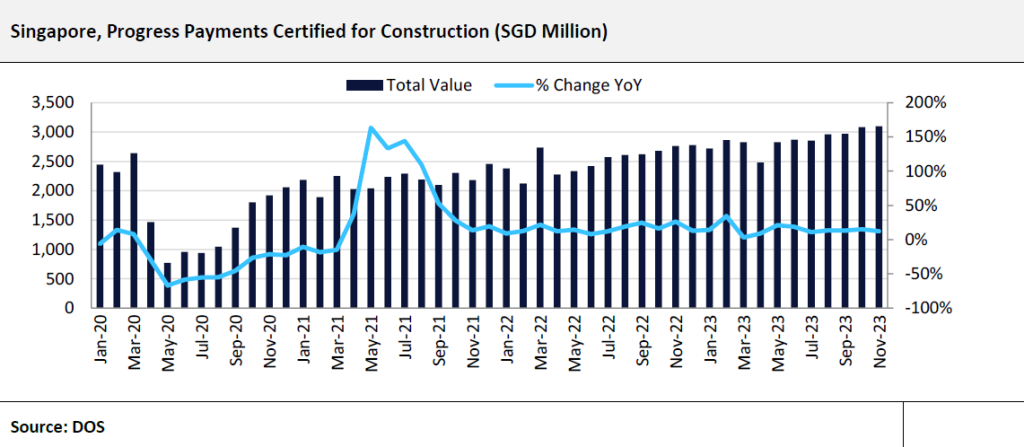

The construction industry’s growth will be supported by an increase in the total value of progress payments issued and the total value of contracts awarded for construction. According to the DOS, the total value of progress payments issued for construction rose by 12.3% year-on-year (YoY) in November 2023, preceded by YoY growth of 15.2% in October and 13.4% in September 2023.

In cumulative terms, payments issued rose by 14.7% YoY in the first eleven months of 2023, increasing from S$27.5 billion from January to November 2022 to S$31.6 billion from January to November 2023. Of the total value of progress payments issued for construction in the first eleven months of 2023, 29.1% was issued for the residential sector, 23.8% for civil engineering works, 23.6% for the industrial sector, 15.4% for the institutional sector and 8% for the commercial sector.

All the sub-sectors of construction have shown significant growth in the first eleven months of 2023, with the value of progress payments issued for commercial construction rising by 41.8% YoY during the period, and that for institutional construction rising by 16.5%, residential by 16.1%, industrial by 16% and civil engineering works by 4.3% YoY.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

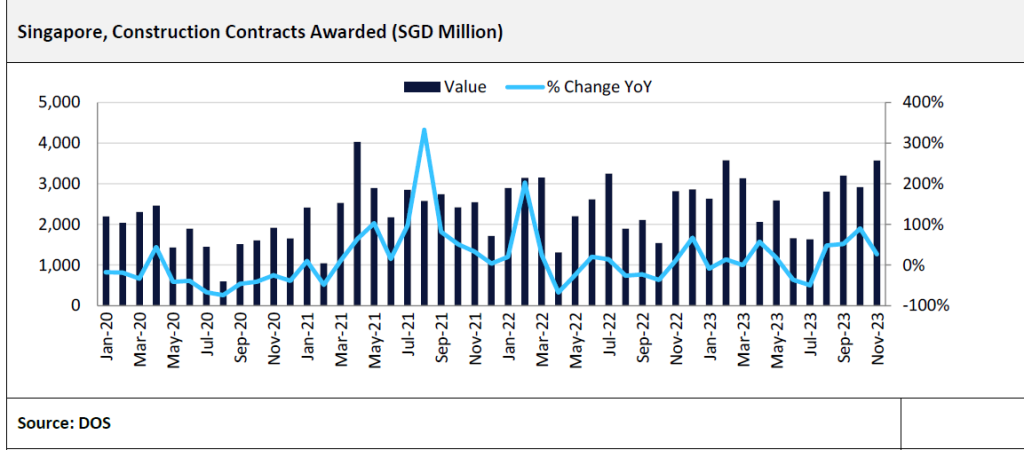

In another boost to the industry’s growth, the total value of construction contracts issued in the country grew by 26.6% YoY in November 2023, following YoY growth of 90.1% in October and 51.7% in September 2023. In cumulative terms, contract value grew by 10.6% in the first eleven months of 2023, increasing from S$26.9 billion from January to November 2022 to S29.8 billion from January to November 2023. Of the total, residential contracts worth S$11.2 billion were awarded from January to November 2022, while S$6.5 billion in civil engineering contracts, S$4.8 billion in institutional contracts, S$4.1 billion in industrial contracts and S$3.2 billion in commercial contracts were awarded during the period.

According to the estimates of the Building and Construction Authority (BCA) compiled in mid-January 2024, the total value of construction contracts to be awarded in Singapore is projected to be between S$32 and S$38 billion in 2024, with the public sector accounting for approximately 55% of the total demand. Some of the significant public sector projects that are scheduled to be awarded in 2024 include the Housing and Development Board’s new Built-To-Order developments, the Cross Island Mass Rapid Transit Line (MRT) contracts (Phase 2) and infrastructure works for the Changi Airport Terminal 5 and Tuas Port developments.

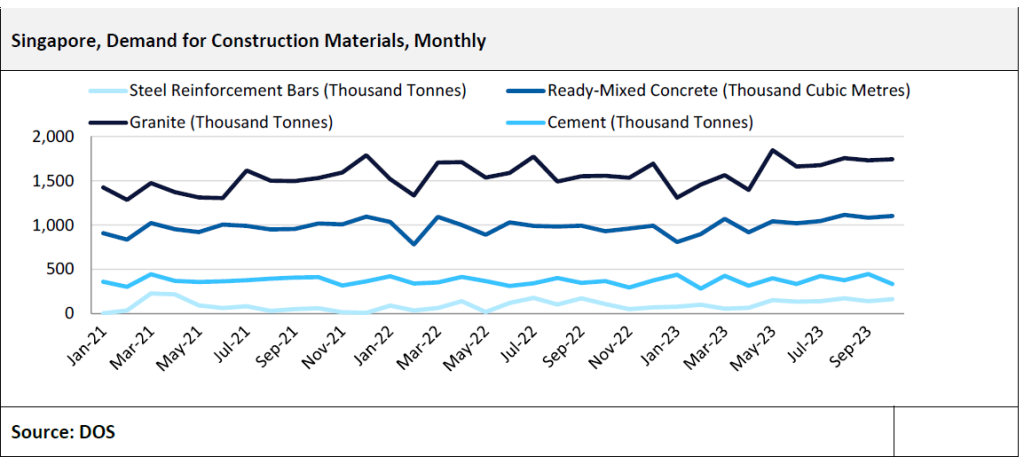

Reflecting the strong outlook for construction output, the demand for construction materials continued to rise in the first eleven months of 2023. According to the BCA, the demand for steel reinforcement bars rose by 16.9% YoY from January to November 2023, while those for ready-mixed concrete, cement and granite rose by 3.8%, 3.2% and 2.3%, respectively, over the same period.

The industry is expected to record an average annual growth of 4.3% from 2025 to 2028, supported by investment in transport, renewable energy and manufacturing projects. The Minister for Sustainability and the Environment reported in early January 2024 that Singapore had achieved more than 50% of its target to deploy at least 2 gigawatt-peak (GWp) of solar power by 2030. The city-state has doubled its solar power deployment since 2021 to more than 1GWp, as of early January 2024.

Work is also progressing on railway infrastructure projects, with civil infrastructure works on Singapore’s portion of the 4km Johor Bahru-Singapore Rapid Transit System Link project reaching a completion rate of 65%, as of early January 2024. The project is on schedule to commence passenger services by December 2026. In another boost to the sector’s output, the Land Transport Authority (LTA) awarded a S$510 million ($372.3 million) civil contract for the design and construction of West Coast station and tunnels for the MRT Cross Island Line (Phase 2) to the local subsidiary of the Malaysian engineering, property and infrastructure company Gamuda Berhad Singapore, in December 2023. Work on this project, which involves the construction of an underground station and 19km of twin tunnels, will begin in the first quarter of 2024. This project is a part of the new Cross Island Line Phase 2, which is the eighth MRT line in Singapore and involves the construction of a 15km line with six underground stations by 2032.