The construction industry in China is estimated to have expanded by 6.5% in real terms in 2023, with the industry’s value add expanding by 7.2% year-on-year (YoY) in the first three quarters of the year, according to the National Bureau of Statistics (NBS).

Growth in 2023 was supported by increased investment in transport and power infrastructure projects.

According to the National Energy Administration, China added 191GW of new renewable energy capacity in the first ten months of 2023, a YoY growth of 90.8%; this consisted of 142GW of solar power, 37.3GW of wind power, 8.4GW of hydropower, and 2.3GW of biomass.

The downturn in the residential construction sector has, however, weighed on the construction industry’s output in 2023, with the sector expected to have registered a sharp fall of 6.2% in real terms in 2023.

This weakness is attributed to subdued investor and consumer confidence amid falling new home prices, elevated debt amongst property developers, and the tightening of government regulations on debt growth.

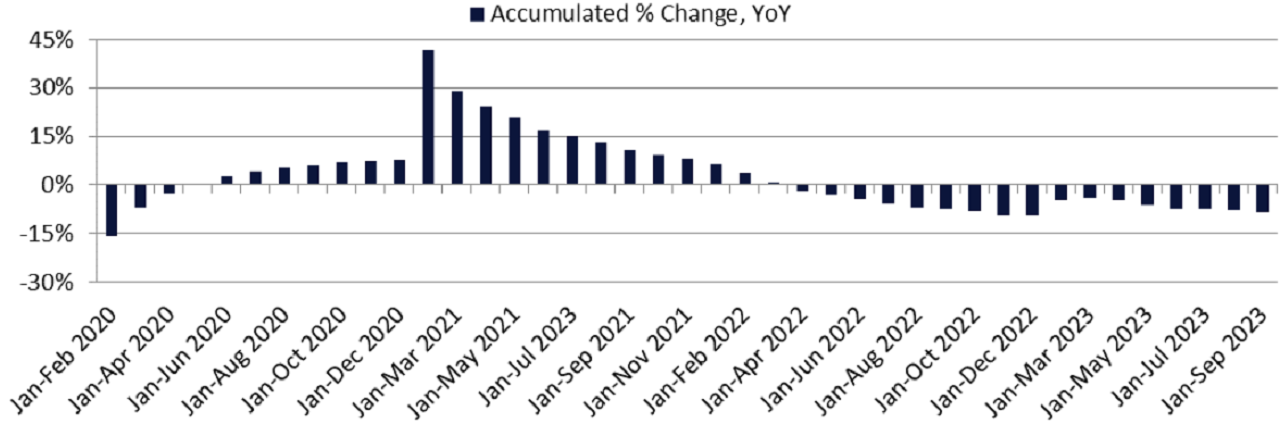

According to the NBS, the total investment in residential real estate development in the country fell by 9% YoY in the first 11 months of 2023; this followed an overall annual fall of 9.5% in 2022 and growth of 6.4% in 2021.

The construction industry’s growth is projected to slow to 2.8% in 2024, owing to continued weakness in the property sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn recent months, several cities have eased mortgage rules to support housing demand.

For instance, in mid-December 2023, authorities relaxed home-buying kerbs in Beijing and Shanghai – the country’s two largest housing markets.

The city authorities reduced downpayment requirements for first-time homebuyers and have changed the definition of ‘non-luxury homes’, thereby allowing more residences to qualify for lower-rate mortgages.

Effective from 1 January 2024, Beijing reduced downpayment requirements for second homes to 40-50% depending on the location – compared to the previous 60-80%; it also reduced the minimum downpayment for first homes to 30%, from 35%-40% previously.

Previously, in August 2023, Guangzhou and Shenzhen eased mortgage kerbs, allowing homebuyers to access preferential loans for first-home purchases regardless of their previous credit records.

However, the stimulus measures rolled out by major cities have yet to support a recovery in demand, with the property sector continuing to drag on China’s economic recovery.

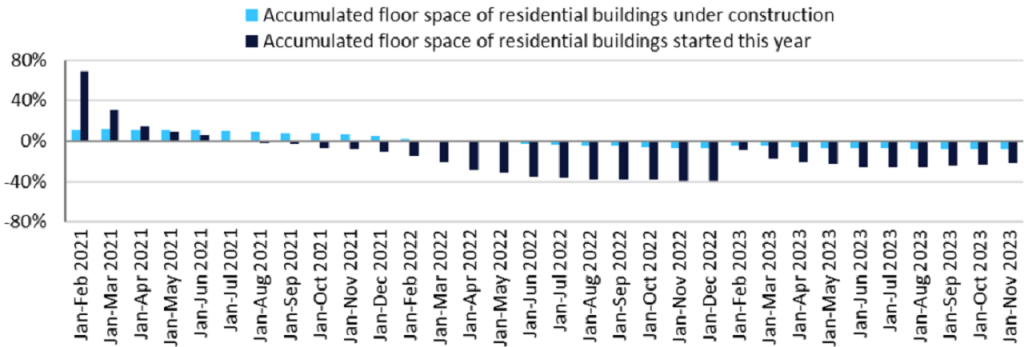

The contraction in China’s residential construction activity and new home sales deepened in the first 11 months of 2023, with the total floor space of residential buildings under construction declining by 7.7% YoY, the total floor space of residential buildings on which construction started declining by 22% YoY, and the total value of residential buildings sold declining by 10.1% YoY during January to November 2023, according to the NBS.

Moreover, according to the preliminary data released by the China Real Estate Information Corporation (CRIC) in late December 2023, the value of new home sales among the top 100 largest real estate companies in China fell by 16.5% YoY in 2023, to 5.4tn yuan ($800.5bn); this is lower than the institute’s estimate of a 15% fall that year.

Only 16 of the top 100 developers reported a sales value of more than 100bn yuan in 2023 – down from that of 20 in 2022. According to the estimates of the CRIC, home sales will remain flat or edge downward in January 2024.

Amid a downturn in demand for residential buildings, several developers are struggling to repay debts and complete projects.

The country has a 3tn yuan shortfall in funding to stabilise the housing sector and complete millions of unfinished apartments.

As of late November 2023, the government was finalising a list of 50 developers eligible for financial support; this includes property giants such as Country Garden Holdings and Sino-Ocean Group.

Additionally, to minimise the risk of additional defaults and ensure that housing projects are completed, Chinese policymakers are urging banks to allocate more funding to the property sector.

To fast-track the completion of housing projects, the government is focusing on streamlining approval processes, by reducing bureaucracy and eliminating unnecessary delays; this will help in addressing the backlog of unfinished apartments.

The government is also prioritising the promotion of affordable housing, to address the housing needs of the population and ensure social stability.

To support the struggling property market, the government is expected to provide 1trn yuan in low-cost financing to support the country’s urban village renovation and affordable housing programmes.

The funding will be provided by the People’s Bank of China through policy banks, to support households purchase homes.