Residential works drove building construction activity in Australia in 2021, supported by record-low interest rates, a sharp rise in dwelling permits and the former government’s initiatives to support first-time home buyers and single-parent purchasers. According to the Australian Bureau of Statistics (ABS), the total value of residential building construction work done in the country rose by 4.9% in 2021, following contractions of 6.6% in 2020 and 7.7% in 2019. Despite registering sharp growth in 2021, growth in the Australian residential construction sector is expected to decelerate in 2022 owing to rising inflation and construction material prices, increasing interest rates and moderation in residential demand.

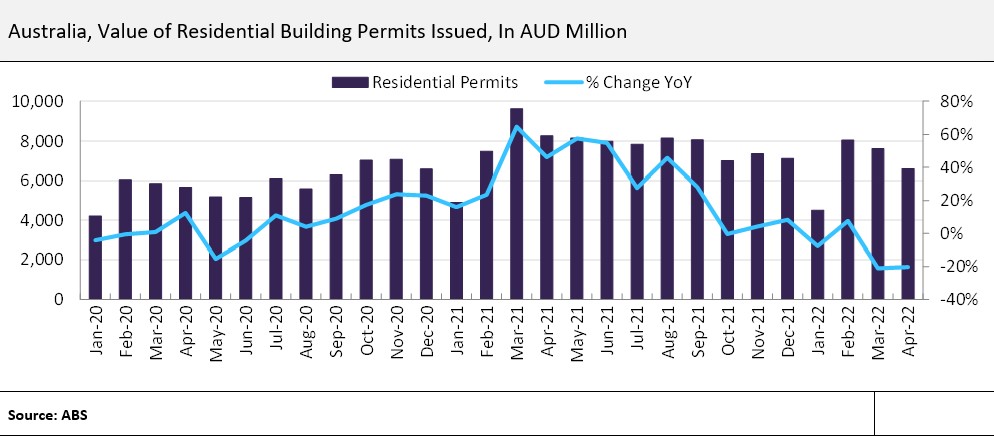

According to the ABS, the total value of residential buildings approved fell by 20.2% year-on-year (YoY) in April 2022 (the latest data available at the time of writing), following a YoY contraction of 21% in March 2022. In cumulative terms, the value of residential permits issued fell by 11.6% YoY in the first four months of this year, falling from AUD30.3bn ($22.7bn) between January and April 2021 to AUD26.8bn ($20.1bn). Victoria accounted for the highest value of residential permits issued in the first four months of this year, equivalent to 20.9%, followed by New South Wales (17%), Queensland (11.5%) and Western Australia (4.2%). Only two of the eight states and territories – Victoria and South Australia – registered YoY growth in terms of the value of residential permits issued in the first four months of this year. During this period, Western Australia recorded the deepest contraction in terms of the value of residential permits issued – equivalent to 44.2% YoY, followed by Northern Territory (-42%), Tasmania (-31.6%) and Queensland (-14%).

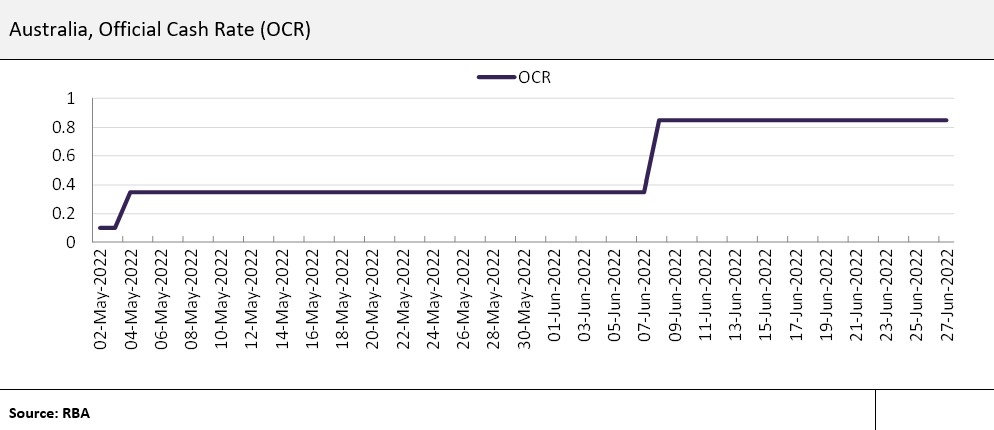

The deceleration in the pace of growth in the residential construction sector in the coming year can be attributed to headwinds owing to the rising inflation and the subsequent rise in interest rates. Inflation in Australia has risen significantly due to global supply chain disruptions and the Russia-Ukraine crisis, and domestic factors such as capacity constraints in some sectors, a tight labour market and flooding in eastern Australia. The Consumer Price Index (CPI) rose by 5.1% YoY in Q1 2022, following a 3.5% increase in the previous quarter. Although Australia’s inflation remains below that of many advanced economies, it is higher than the Reserve Bank of Australia’s (RBA) forecasts. In mid-June 2022, the governor of the RBA predicted that headline inflation in Australia was likely to hit 7% by the end of 2022. To contain the surge in inflation, in early June 2022, the RBA raised interest rates for the second consecutive time in 35 days. It raised the Official Cash Rate (OCR) by 50 basis points to 0.85% in early June 2022, the largest monthly rate hike since February 2000. The RBA has also warned that further increases in the OCR can be expected in the coming months.

The rise in interest rates and the associated increase in the cost of borrowing is expected to soften housing demand in the coming quarters. According to the Housing Industry Association (HIA) of Australia, the rise in interest rates has already begun to weigh on housing demand, with the total number of new home sales falling by 5.5% month-on-month (MoM) in May 2022 (the latest data available at the time of writing), following a MoM contraction of 1.2% in April 2022. The anticipated additional rise in interest rates is expected to lead to a further fall in housing demand due to buyers’ reduced borrowing power, a fall in demand for mortgages and an increase in vendors’ reluctance to sell in a cooling market. Subsequently, housing prices are expected to fall over the coming quarters. According to the Commonwealth Bank of Australia (CBA), house prices could plunge by 18% in Sydney and Melbourne in the next two years, and could fall by 11% across Australia over the next 18 months.

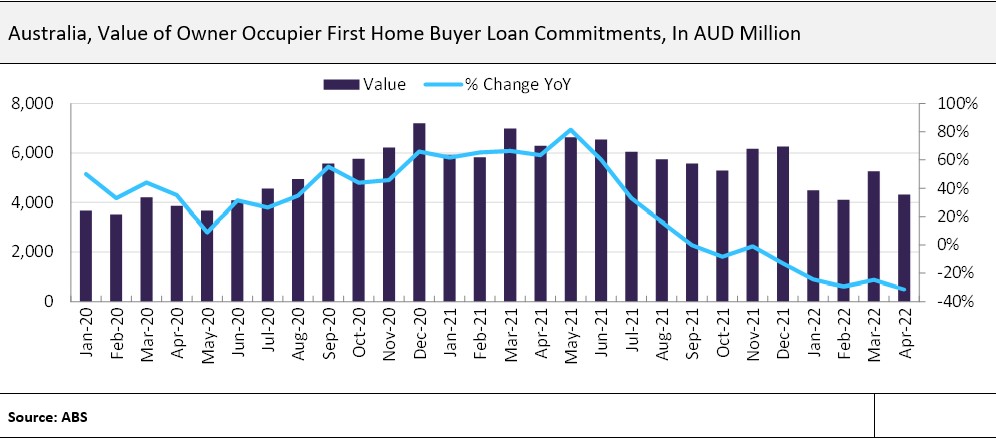

Reflecting the current weakness in the residential sector, the value of owner-occupier first home buyer loan commitments fell by 31.6% YoY in April 2022 (the latest data available at the time of writing), the fifth consecutive double-digit Y-o-Y contraction since December 2021. Cumulatively, it fell by 27.5% in the first four months of this year, declining from AUD25bn ($18.7bn) between January and April 2021 to AUD18.1bn ($13.6bn) between January and April 2022. Victoria accounted for the greatest proportion of the nationwide value of owner-occupier first home buyer loan commitments made during the first four months of this year – equivalent to 33.2%, followed by New South Wales (26.9%) and Queensland (17.7%). All states and territories registered YoY contractions in terms of owner-occupier first home buyer loan commitments during the first four months of this year, with the Northern Territory registering the highest YoY contraction (-52.5%), followed by South Australia (-34.7%), Queensland (-32.8%) and Tasmania (-32.3%).