The Nigerian President, Bola Tinubu, announced in early February 2025 that he plans to increase the 2025 budget expenditure from N49.7trn ($33.1bn), which was initially presented to the National Assembly in December 2024, to N54.2trn. This represents a 9.1% increase compared to the previous announcement and follows a reported rise in tax and customs revenue. For instance, the Nigeria Customs Service generated an additional N1.2trn while the Federal Inland Revenue Service (FIRS) raised a further N1.4trn, and other government-owned agencies contributed an additional N1.8trn. Consequently, the elevated 2025 budget expenditure will signify a substantial increase compared to expenditure levels in previous years, which stood at N27.5trn in 2024, N21.8trn in 2023, and N17.1trn in 2021.

The proposed increase in expenditure will be allocated to several key areas. Specifically, N1.5trn will be dedicated to critical infrastructure projects with the aim of enhancing the country’s infrastructure. Additionally, N1trn will be allocated to the solid minerals sector, with the goal of diversifying the economy by unlocking the untapped potential of Nigeria’s vast solid mineral resources. Furthermore, N500bn will be provided to support small and medium enterprises, promote local manufacturing, and reduce the country’s reliance on imports, which currently weighs on gross domestic product (GDP) growth.

Of the total funding earmarked for the critical infrastructure projects, N700bn will be allocated for transport infrastructure projects (of which, 57.1% will be channelled towards light rail network development in urban centres and 42.9% of funding will help to develop and rehabilitate critical roads). In addition, N380bn will be made available for irrigation development, N250bn will build military barracks accommodation and N50bn will boost border communities’ infrastructure. Overall increased capital expenditure on infrastructure can help to improve business efficiency, reduce operational costs for companies, and boost investment confidence. However, significant foreign exchange challenges could contribute to a foreign currency gap, impacting foreign investment and increasing business costs. As a result, this may impact the country’s economic diversification efforts.

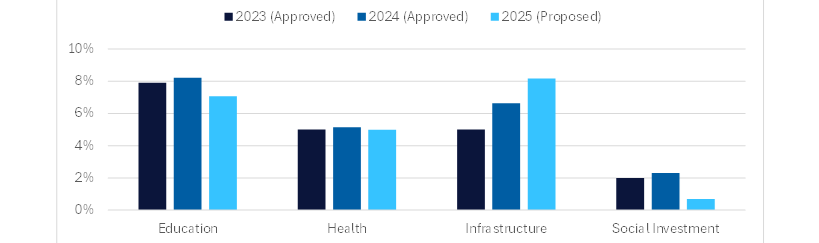

The 2025 national budget was formulated against a backdrop of challenging global and domestic economic conditions such as inflationary pressures, exchange rate volatilities, and fiscal constraints. The budget had prioritised the defence and security sector – which accounted for 9.9% of the overall budget allocation while the infrastructure (8.2%), education (7.1%), and health (5%) sectors all received significant contributions. Additionally, the government had increased its allocation for capital expenditure by 12.5%, to N14.1trn. The budget also incorporates a series of pivotal reforms, including an increase in the minimum wage, the implementation of duty-free food imports, and revisions to the tax code. Alongside the significant rise in spending, Nigeria has set a target inflation rate of 15.75% and aims to achieve a GDP growth rate of 4.6% in 2025.

Despite this, the government has marginally decreased the percentage share of allocations for the health and education sectors in 2025. Spending on health has dropped from 5.2% in 2024 to 5% in 2025 while education spending has declined from 8.2% in 2024 to 7.1% in 2025. The decrease in government spending on education follows a sharp rise in the percentage of children out of school, which increased from 15% in 2023 to 25.60% in 2024. However, after increased spending aimed at strengthening the primary healthcare system, as well as expanding public health campaigns and improving healthcare financing, Nigeria’s life expectancy increased from 55.75 years to 56.05 years between 2023 and 2024.

To raise further capital, the latest Nigerian government budget also set a target to increase crude oil production from 1.78 million barrels per day (mbbl/d) in 2024 to 2.06mbbl/d in 2025. Although, achieving this target could be challenging, due to persistent issues such as pipeline vandalism, oil theft, and declining investments. With oil revenues expected to contribute 56% of the total government revenue, these constraints are likely to jeopardise fiscal sustainability.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDespite helping to address the country’s critical challenges and advancing its development agenda, the increased budget does raise concerns over the country’s fiscal sustainability. Nigeria’s budget deficit, which is already estimated at approximately N13trn, is likely to grow further by an additional N4.5trn because of the announced expenditure increases. The proposed budget expenditure increase is based on projected revenue gains from FIRS, customs, and other agencies, which have not yet been realised and are likely overly optimistic. Historically, Nigeria has grappled with revenue shortfalls, which can lead to overestimated revenue projections, exacerbating the fiscal deficit and leading to increased borrowing. If not managed prudently, this trend has the potential to escalate inflation and debt servicing costs, further undermining economic stability.