New Zealand recorded its first suspected case of the Delta variant on August 17th, 2021, and, in line with its zero-Covid policy, the government immediately placed the entirety of the country into an alert level 4 lockdown. By the end of the third quarter of 2021, Auckland had spent a total of thirty-five days under level 4 restrictions and a further nine days under level 3 while the rest of New Zealand spent a total of fourteen days in level 4 lockdown. Given the significant limiting of economic activity while under level 4 restrictions, including the prevention of non-essential construction works, it comes as no surprise that in Q3 2021 the New Zealand economy recorded its second-largest quarterly contraction since current records began. According to Stats NZ, the gross domestic product fell to NZD65.6bn ($44.7bn) in Q3 2021, a Q-o-Q fall of 3.7%, and a year-on-year (YoY) fall of 0.3%. Encouragingly, however, this contraction was significantly softer than expected, with the Reserve Bank of New Zealand (RBNZ) initially projecting a quarterly contraction of 7%.

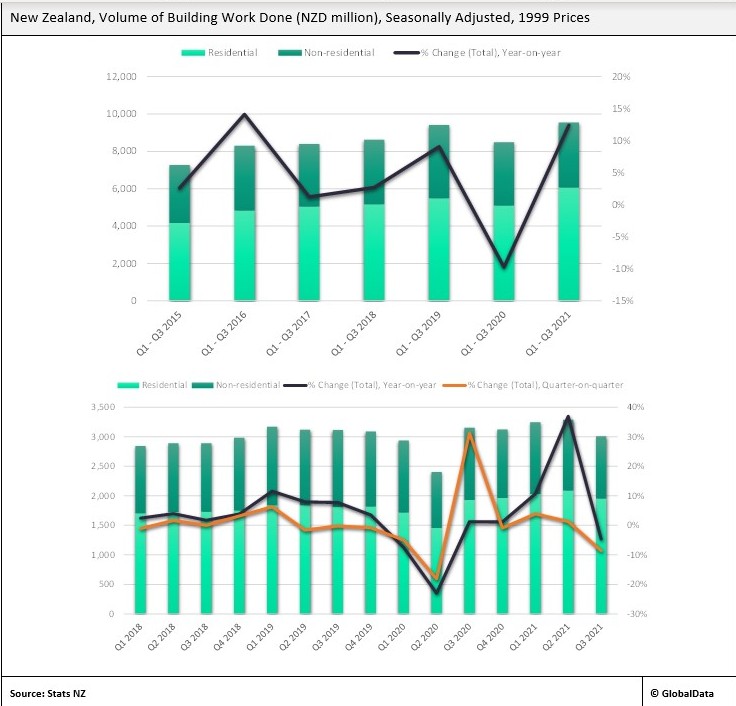

The f restrictions also weighed heavily on construction activity. The value-add of the construction sector fell to NZD4.2bn ($2.8bn) in Q3 2021, a contraction of 9.6% QoQ and 11.1% YoY. A similar, though slightly less drastic, fall was observed in the volume of construction work completed during the quarter, which fell by 8.6% QoQ, and 4.6% YoY. Residential construction completions were relatively more resilient, recording a contraction of only 6.4% QoQ and a growth of 1.2% YoY. In contrast, non-residential completions were down significantly during the quarter, recording contractions of 12.5% QoQ, and 14% YoY. Owing to the prolonged period spent under level 4 restrictions, the value of construction completed in Auckland recorded a far greater decline than either that completed in the rest of the North Island or that completed in the South Island; falling by 11% QoQ, in comparison to falls of 0.4% in the rest of the North Island and a fall of 1.7% in the South Island.

However, the downturn in construction activity in the third quarter of 2021 is likely only to be a temporary setback for the New Zealand construction industry, with the record number of building consents issued in the first ten months of the year indicating a far brighter outlook moving forwards. In the first ten months of 2021, the number of building consents issued rose to 44,539, a 23.5% increase on the 36,052 issued in the first ten months of 2020 and a 21.7% increase in the number of consents issued in the first ten months of 2019. Driving this growth is the intense volume of residential building activity, with consents up 26.1% YoY between January and October 2021 to 40,083 and up 27.5% on the first ten months of 2019. In contrast, non-residential consents increased by 4.5% YoY but were down by 13.8% when compared to the same period in 2019.

GlobalData currently expects the New Zealand construction industry to have recorded growth of 8.1% in 2021 and to record a growth of 7.8% in 2022. However, downside risks to the outlook are relatively significant, including accelerating inflation, rising materials and wage costs and the threat posed by the Omicron variant. The RBNZ increased its official cash rate (OCR) to 0.75% on November 24th, 2021, citing rising price pressures, tightening capacity and above sustainable employment levels. Rising funding costs due to the OCR increase are likely to weigh on demand for greater capacity in those sectors where uncertainty remains elevated, predominantly affecting the commercial sector. The NZ Government postponed the return of quarantine-free travel in response to the spread of the Omicron on the 21st December 2021, in addition to increasing the quarantine period from seven days to ten. Quarantine-free travel was initially to be opened to New Zealanders and visa holders resident in Australia on the 17th January 2022, but this has been postponed until the end of February 2022. This is likely to push back the initially planned border reopening in April, delaying the recovery of the NZ tourism industry and further constraining demand for commercial capacity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData