The impact of rising prices and the war in Ukraine on Eastern European economies has so far been less severe than expected, with GDP growth in the first quarter of 2022 exceeding expectations in many countries in the region. Romania’s economy grew by 5.2% year on year in Q1, its highest rate of growth since Q4 2020, after growing by 1% in Q4 2021 while Poland recorded GDP growth of 2.4%, following growth of 1.8% in Q4 2021. Moreover, Hungary managed to maintain a growth rate above 2% in Q1, following a relatively strong performance in Q4 2021. The construction industry across the region also performed relatively well during this period, despite the significant headwinds it faces. So far, the rate of capital flight from the region has been far slower than expected while currency values have remained buoyant. However, downside risks owing to construction cost inflation and the war in Ukraine remain pertinent for the foreseeable future.

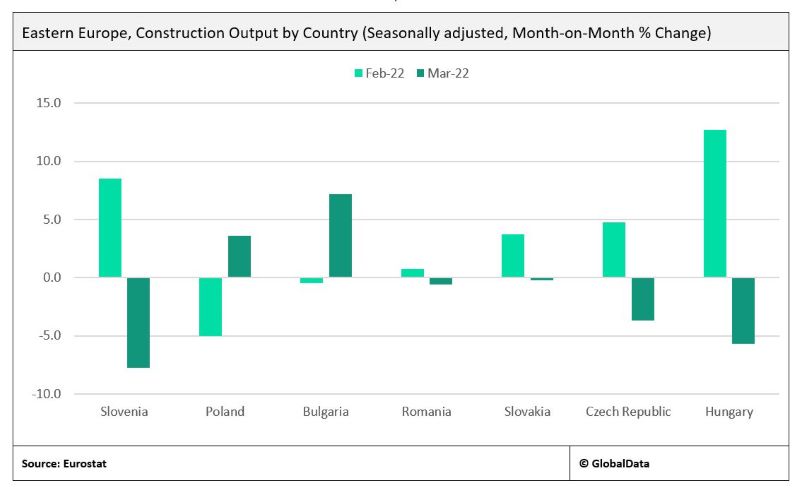

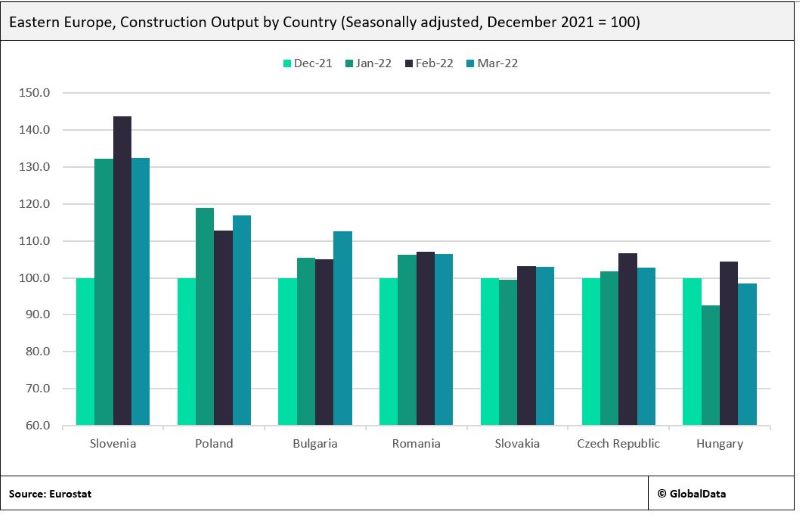

Construction output data for March 2022 shows that construction activity in Eastern Europe weakened slightly, following the onset of war in Ukraine. However, the impact felt by individual countries was mixed, with the construction industry in Poland expanding by 3.6% month-over-month (MoM) in March, on a seasonally adjusted basis, and in Bulgaria by 7.2%. The most pronounced drop off in activity was recorded in Slovenia, which contracted by 7.8% in March. However, construction output in Slovenia grew rapidly in the first two months of 2022, with output levels in March still 32.2% higher than in December 2021.

Output in Hungary also dropped significantly in March, recording a contraction of 5.7% from February, falling to 1.5% below its December 2021 level. This, in part, reflects Hungary’s already elevated output level following a strong performance of the construction sector in 2021 and February 2022. Moreover, output in the Czech Republic fell by 3.7% after gaining some growth momentum in late 2021 and early 2022 while output levels in Romania and Slovakia declined marginally MoM in March by 0.6% and 0.2%, respectively.

Despite the marginal drop off in activity in March, the short-term outlook for the industry looks relatively positive, taking into account the leading indicators. In Hungary, the number of residential building permits issued in March reflected a 49% increase on permits issued in February while in Poland, the total number of building permits rose by 18%, and in the Czech Republic by 15%. Moreover, the Construction Project Momentum Index (CPMI), as tracked by GlobalData, showed an improvement in the health of the project pipeline in April, following a severe downturn in the rate of progress on projects in March, driven by the halting of projects in the pre-execution phase.

The improvement in April suggests a rise in confidence in moving these projects through into execution. This may indicate a greater resiliency within the industry to navigate headwinds. However, the full extent of the pressures on the industry are unlikely to have been realised yet. Despite this short-term buoyancy, the industry’s outlook over the medium-term remains gloomy, owing to the risks facing the industry remaining heavily on the downside.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData