Although it is far too early to predict how Russia’s invasion of Ukraine will play out and attention in the immediate term will be on the human costs of the military actions, there will be severe disruption to economic activity and investment in both countries and potentially the wider region.

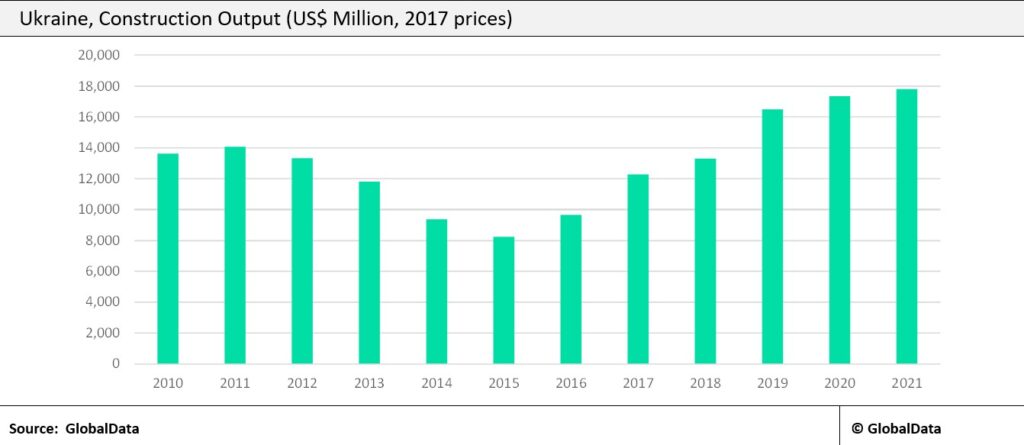

In terms of construction, Ukraine had been expanding rapidly and was not affected by the Covid-19 crisis to the same extent as other markets in Europe. Ukraine’s construction industry grew by 5.2% in real terms in 2020, following annual growth of 23.9% in 2019. GlobalData estimates that the industry continued to expand in 2021, growing by 2.6% in real terms, driven by continued investment to improve the country’s infrastructure, coupled with increased spending in the health and education sectors. The industry had been predicted to continue to grow at a healthy rate in 2022 and beyond, supported by the government’s investment in transport infrastructure, energy and utilities and industrial construction projects. For example, in the 2022 state Budget, a record $5.1bn had been allocated for the development of infrastructure.

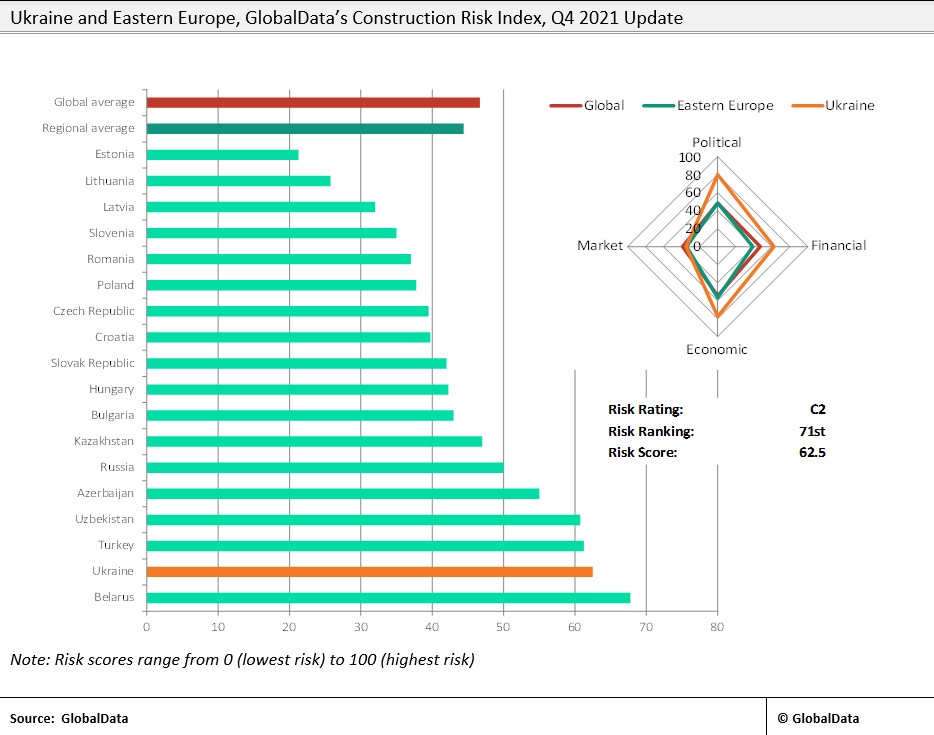

However, the outlook is now much bleaker, with major projects currently underway likely to be stalled and new investment plans put on hold while the government’s attention and financial resources are redirected to the military defensive efforts. Moreover, private investment will also be scaled back dramatically. Although the industry had been expanding and the outlook had been promising, owing primarily to its high political risk assessment, in GlobalData’s Construction Risk Index, Ukraine was ranked 71st out of 92 markets covered in the latest update.

Prior to the recent events, the outlook for Russia’s construction industry had also been promising. Unlike other major markets across Europe, it had managed to avoid a major downturn in 2020 and is estimated to have expanded by around 4% in 2021. Growth this year and in the coming years was also predicted to be healthy, buoyed by government investment in infrastructure, residential and renewable energy projects. For example, in order to strengthen regional infrastructure, the government had implemented over 150 infrastructure investment projects worth more than US$8.1 billion in 26 regions across the country by 2030. Although the level of disruption to construction projects stemming directly from the military invasion is limited when compared to that expected in Ukraine, investor confidence is set to deteriorate and there will be a continued withdrawal of foreign capital. The fall in the rouble will also compound challenges facing the industry in terms of the rising cost of key construction materials and a scaling up of targeted financial sanctions could further impact investment.

There is also a risk that other European markets bordering Russia will suffer disruption if investor confidence in the wider region takes a hit. The Baltic states (of Latvia, Lithuania and Estonia) have been recovering relatively well from Covid-19 disruption and in GlobalData’s most recent assessment construction in these markets was predicted to expand by 4%-5% in 2022. It is a similar outlook for Poland and Romania, which are NATO members bordering Ukraine and potentially facing a risk of fallout from the military conflict in Ukraine.

There will also be an indirect impact on construction further afield as Russia’s military intervention exacerbates upward pressure on oil and energy prices, feeding into even higher costs for production and transportation of key construction materials. Ukraine is also a major producer of steel, global prices of which soared in 2021.

While it is difficult to see past the immediate military conflict in terms of what the outcome might be for Ukraine, Russia’s military actions are likely to accelerate the post-pandemic trend of deglobalisation as sovereign states seek to generate more secure supplies of energy and commodities in the face of rising geopolitical tensions and volatile prices. This is likely to increase demand for domestically-produced energy in western European countries, notably Germany, which has a relatively high dependence on Russian oil and gas, leading to higher levels of spending on constructing new energy plants and transportation systems.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

NATO