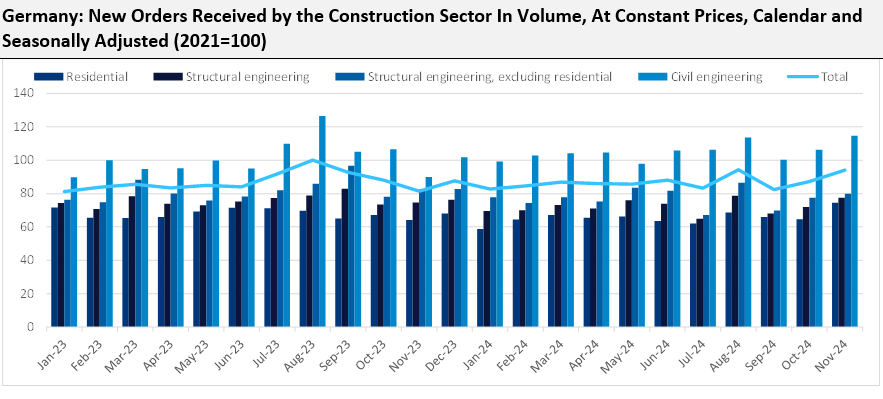

Leading data and analytics company GlobalData expects Germany’s construction industry to continue to shrink in 2025 after remaining weak in 2024 and estimates to register a marginal real-term decline of 0.5% in 2025, marking its fifth consecutive year of decline. This decline is attributed to a series of headwinds, including the impact of high inflation, rising material costs, and elevated interest rate hikes, alongside a corresponding lack of demand, leading to major companies being pushed into insolvency. Growth in 2025 will also be affected by continued weakness in the residential sector, coupled with a sharp fall in residential building permits issued. Furthermore, Germany encounters obstacles in reaching its housing goals, despite the substantial investment and possible advantages of modular construction. The federal government aimed to construct 400,000 new apartments each year; however, only 295,000 were completed across the country in 2023. This represents a decrease of 0.2% compared to 2022. Given the current housing slump, it is highly likely that the government will miss its target in 2024. According to data published by Deutsche Bundesbank, residential construction orders received in terms of volume index fell by 3.3% year-on-year (YoY) in the first 11 months of 2024, followed by drops of 4.6% YoY in structural engineering work orders and 5.3% YoY in structural engineering, excluding residential work orders during the same period.

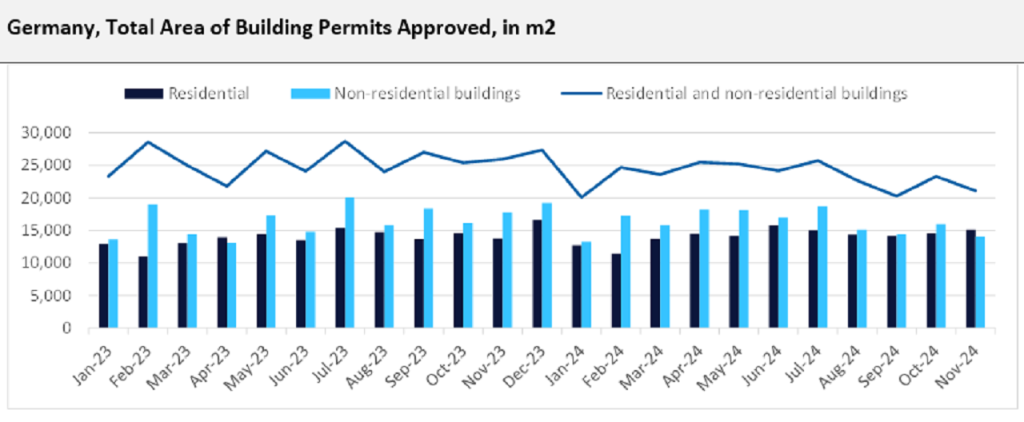

In a setback to the industry’s output, the total area of building permits issued in the country fell 8.8% YoY in January-November 2024, with permits issued for residential and nonresidential buildings declining by 22.2% and increasing by 1.3%, in YoY terms, respectively, during that period. By segments, permits for residential buildings with one or two apartments fell by 20.3%, while those with three or more apartments fell by 23.8% YoY, during that period.

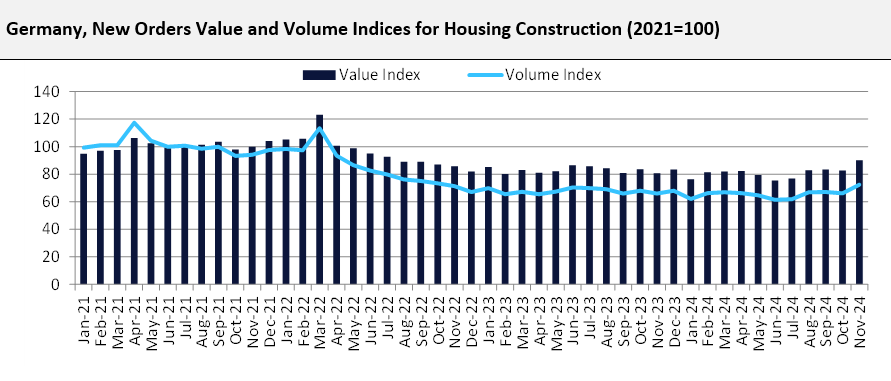

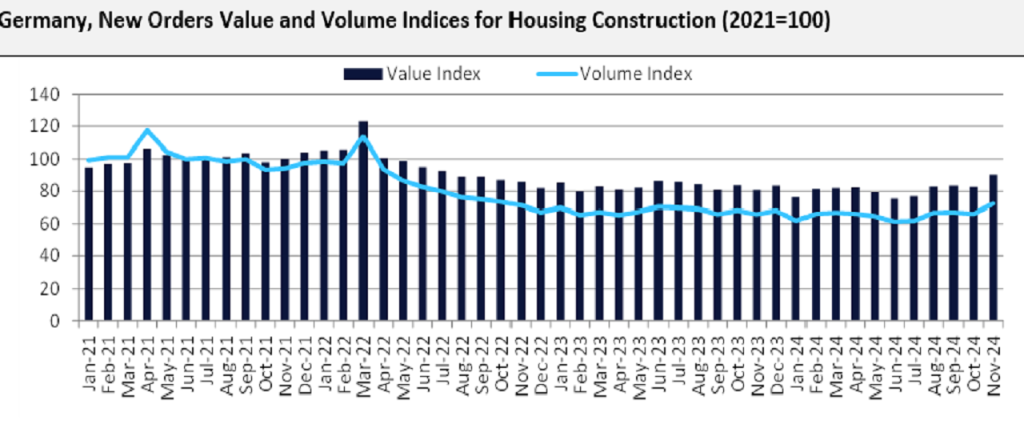

According to the Federal Statistical Office (Destatis), the new orders value index for housing construction also fell by 2.2% YoY, in the first 11 months of 2024, decreasing from 83 in January-November 2023 to 81.1 in January-November 2024. Meanwhile, the new orders volume index declined by 3.1% YoY, during the same period, falling from 67.7 to 65.6.

In addition, increasing insolvencies in the country will also have a direct impact on the construction industry’s output in 2025. According to Destatis, the total number of companies that applied for insolvency proceedings increased by 23.6% YoY in the first ten months of 2024, rising from 14,751 in January-October 2023 to 18,234 in January-October 2024; this significant increase in insolvency is expected to affect 159,177 employees, which is 12.6% YoY higher than 141,361 affected employees in same period of 2023.

The German housing market is likely to continue to be the hardest hit in terms of total economic output among other sectors, marking it the weakest among European housing markets. The latest survey from the ifo Institute (Leibniz Institute for Economic Research at the University of Munich) revealed that the business climate in construction dropped to -28.2 points in January 2025, a decrease from -26.2 points in December 2024. Additionally, in December 2024, 53.6% of companies reported a lack of orders in the residential construction sector, following 54% in November 2024. The housing crisis in the country is likely to continue its downturn in 2025 due to the ongoing political uncertainty in the country with the next snap election to be held in late February 2025. This will limit the investment in the residential construction sector, which has been declining since 2021, and is in dire need of investment to improve the existing situation. However, over the medium to long term, the residential construction sector is expected to grow, fuelled by public and private investment in the sector. In November 2024, the federal Ministry of Housing proposed a law aimed at simplifying construction practices across the country. This law focuses on adopting straightforward and cost-effective building methods while eliminating certain requirements related to housing construction. The goal is to make the building process easier and faster. Also, in June 2024, the government announced a non-profit housing law, which aims to subsidise companies that provide affordable homes on a long-term basis. Furthermore, the government’s plan is to invest €20bn ($20.6bn) in affordable housing construction by 2028. The residential sector is expected to regain growth momentum in 2026.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData