France’s construction industry has suffered from multiple headwinds owing to high interest rates, construction material costs, and supply chain disruptions.

Moreover, the residential sector, which accounts for more than 33% of France’s construction industry, continues to face challenges owing to weaker demand and a fall in the number of building permits issued.

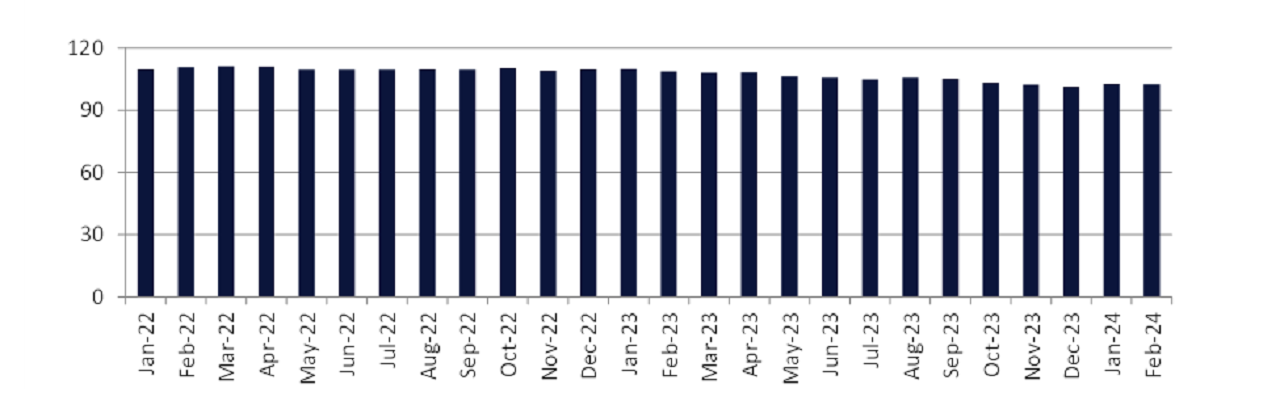

According to the National Institute of Statistics and Economic Studies (INSEE), the total floor area of dwelling units authorised in the country fell by 15.7% year-on-year (YoY) in January 2024, preceded by a YoY decline of 5.3% in December and 8% in November 2023.

Annually, the total floor area of authorised dwellings fell by 27.1% YoY in 2023, owing to decreased purchasing power, coupled with increased construction costs and tight borrowing conditions.

Despite the various headwinds, the business climate in construction remained positive in recent months, supported by investments in the infrastructure and energy sectors.

According to the business managers surveyed in February 2024, the business climate in the construction industry remained stable in February 2024 compared to January 2024.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to the INSEE, the business climate composite index in construction reached 102.6 in January 2024, compared to 102.8 in January 2023 and 101.5 in December 2023, with the indicator remaining above its long-term average (100).

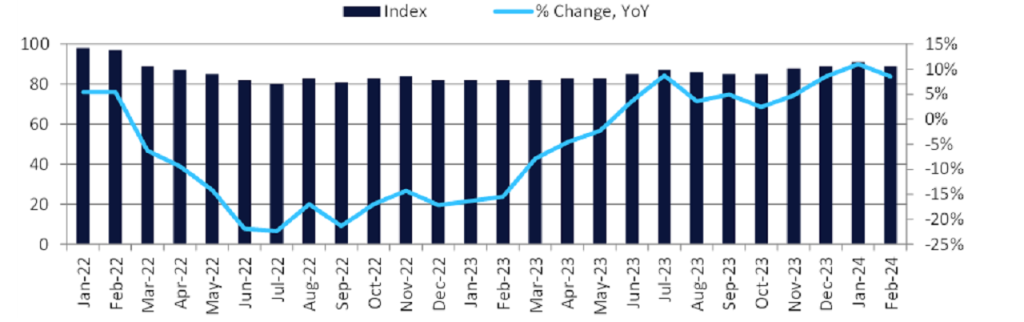

France’s consumer confidence also improved in recent months, with the consumer confidence index rising by 8.5% YoY in February 2024, preceded by YoY growth of 11% in January 2024, and 8.5% in December 2023, according to the INSEE.

The index is an indicator, which can provide an idea of future developments of households’ consumption and saving.

The average consumer confidence index registered a YoY decline of 1.4% in 2023, decreasing from 85.9 in 2022 to 84.8 that year.

This was preceded by an annual decline of 12.8% in 2022.

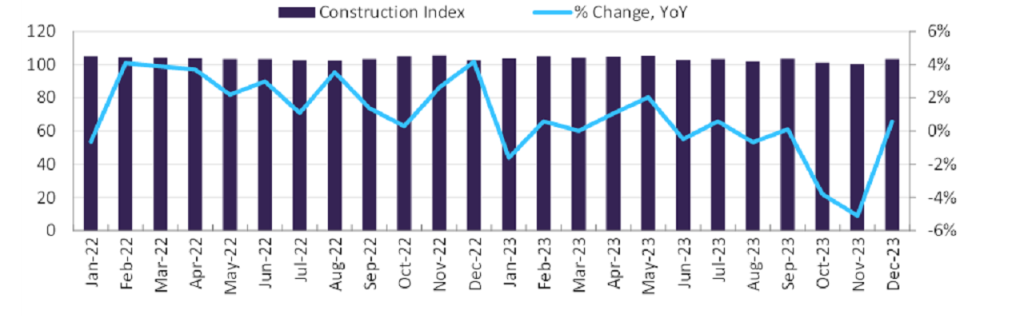

According to the latest data published by Eurostat, the construction production index in France grew marginally by 0.6% YoY in December 2023, preceded by a YoY decline of 5.1% in November and 3.8% in October 2023.

In terms of segmentation, the construction production index for civil engineering works grew by 4.5% YoY in December 2023, whereas that for buildings grew by only 0.2% YoY during the same period.

Cumulatively, the average construction production index declined by 0.6% YoY in 2023.

However, the underlying macroeconomic environment will continue to pose downside risks to the construction industry over the coming quarters.

The residential sector will account for much of the downturn in 2024, owing to a sharp decline in the number of building permits issued.

Thus, GlobalData, a leading data and analytics company, expects the construction industry in France to contract by 2.5% in 2024.

However, over the remainder of the forecast period (2025-28), the construction industry’s growth will be supported by the government’s long-term plan to expand the transport networks in France, coupled with public and private-sector investments in green energy and offshore wind energy projects.

In December 2023, the European Commission (EC) approved funding of €4.12bn ($4.46bn) to support the development of renewable offshore wind energy in a bid to transform the country into a net-zero economy.

Furthermore, in January 2024, the EC approved a €2.9bn French aid scheme to support investments in green industries.