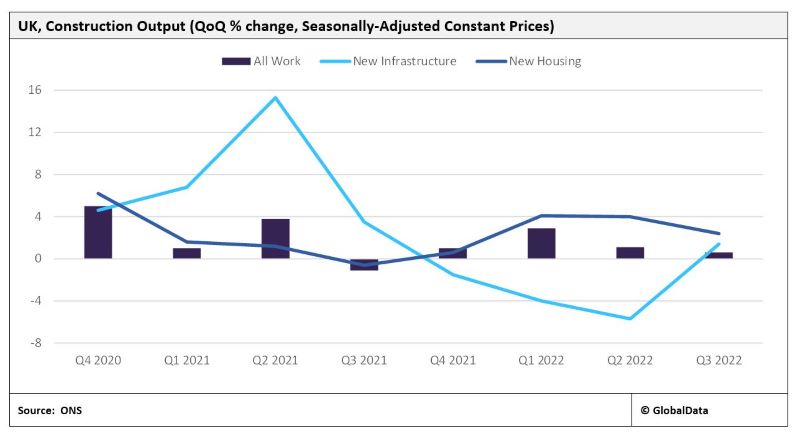

The UK construction industry performed better than expected in the third quarter of 2022, posting an expansion of 0.6% quarter on quarter (QoQ) in real seasonally-adjusted terms. However, amid the backdrop of a weakening economy, rising inflation, and a tightening in monetary policy, the pace of growth in the construction industry has slowed, dropping from 1.1% in the previous quarter and 2.9% in the first quarter of the year. When compared to the same period a year earlier, output in third quarter posted a strong growth of 5.8%.

The positive outturn in the July-September period was driven by new construction works, which grew by 2.4% QoQ, offsetting the 2.2% contraction in repair and maintenance works. In terms of sectors, new housing construction was up by 2.4% QoQ and 11.6% year on year (YoY). After three successive quarters of decline, there was a 1.4% QoQ increase in new infrastructure work. Private industrial construction works have continued to soar, growing by 6.8% QoQ, and on a YoY basis by 60%. The output of private commercial construction also made further gains, growing by 5.1% QoQ and 8.1% YoY. However, commercial construction output was still 26% below the level recorded in Q4 2019.

The performance of the construction industry in the third quarter has been widely taken as a sign of its resilience, and this sentiment was further backed by the positive outturn in the data for new construction orders. In Q3 2022, the seasonally-adjusted value of new orders in constant prices was up by 6.4% QoQ and 8.5% YoY. However, there were mixed results across the sectors. Housing construction orders have continued on a downward trend, falling by 5.8% QoQ and 14.0% YoY, dropping to the lowest level since Q3 2020, while new infrastructure work recorded the highest level of new orders since Q1 2020.

Although the industry performed relatively well compared to other sectors in the economy in Q3 2022, despite the challenges presented in the form of high costs for materials and energy, the outlook remains gloomy. Recent political instability and reversals in economic policymaking decisions have dented investor confidence, which had already been hit by concerns over the looming economic downturn and rising interest rates. The Bank of England, which increased interest rates to 3% in November and is expected to raise rates further in 2023 amid high inflation levels, also recently estimated that a recession in the UK economy could last until mid-2024. With weakening investor confidence and a squeeze on household incomes, there is a risk of planned projects being delayed or put on hold, and the surge in borrowing costs in particular will be a challenge for the residential sector.

The UK government’s finances are also coming under intense scrutiny amid questions of how to fill a GBP50 billion ‘black hole’ and this means that major public investments in infrastructure and energy could be scaled back or scrapped. The High-Speed 2 railway remains controversial given the high costs associated with the development, and the future of the Northern Powerhouse Railway investment plans are still uncertain. There has also been speculation recently on the possibility that the plans for the Sizewell C nuclear power project will be reviewed, although government sources are reported to have said that it would not be delayed.

The UK construction industry has proved to be resilient to date, recovering well from the disruption caused by the pandemic, such that in Q3 2022 output in real terms was 2.8% higher than in Q4 2019. However, in the coming quarters, GlobalData expects the industry to weaken, such that the industry will record a contraction in 2023.