Challenges Faced by UK Construction Industry

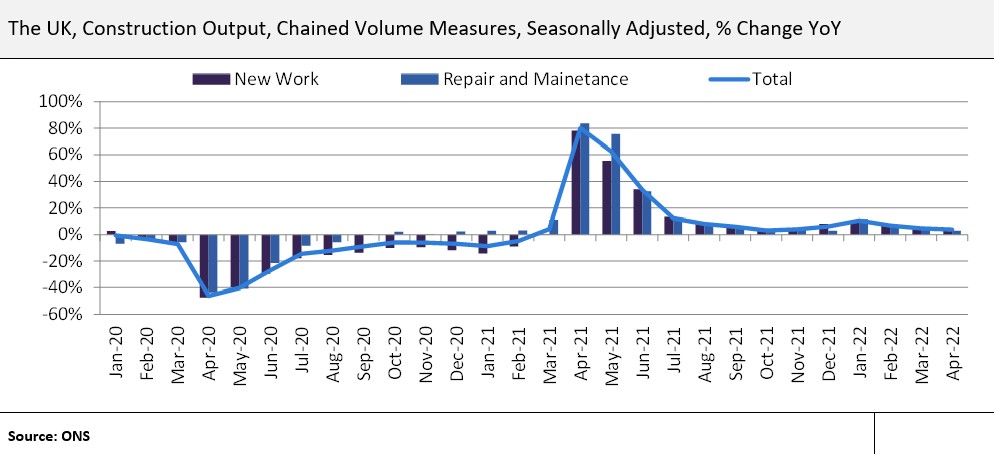

GlobalData expects the construction industry in the UK to expand by 3.4% in real terms this year, supported by a sharp rise in new construction orders and progress on new construction and repair and maintenance works. According to the Office for National Statistics (ONS), the total value of construction output (measured in seasonally adjusted terms) rose by 3.9% year-on-year (YoY) in April 2022 (the latest data available at the time of writing), marking the 14th consecutive Y-o-Y growth since March 2021. In month-on-month (MoM) terms, however, it fell marginally by 0.4% in April 2022, marking the first MoM contraction since November 2021. This contraction is due to a fall in repair and maintenance works (-2.4%), which can be attributed in part to the high base effect of March 2022, during which there was a strong demand for repair and maintenance works following the Dudley, Eunice and Franklin storms of February 2022. In contrast, new works registered a MoM growth of 0.9% in April 2022. Cumulatively, the total value of construction output registered in Great Britain rose by 6.5% YoY in the first four months of 2022, supported by a rise in both repair and maintenance works (6.7%) and new works (6.3%).

Despite registering strong growth in the first four months of 2022, over the remaining part of the year, the construction industry is expected to witness headwinds due to rising inflation, higher interest rates, rising construction material prices, labour shortages and supply chain disruptions. According to the Construction Skills Network (CSN) report published by the Construction Industry Training Board (CITB) in mid-June 2022, 53,200 additional workers will be required annually to meet the UK construction demand by 2026 – up from last year’s figure of 43,000.

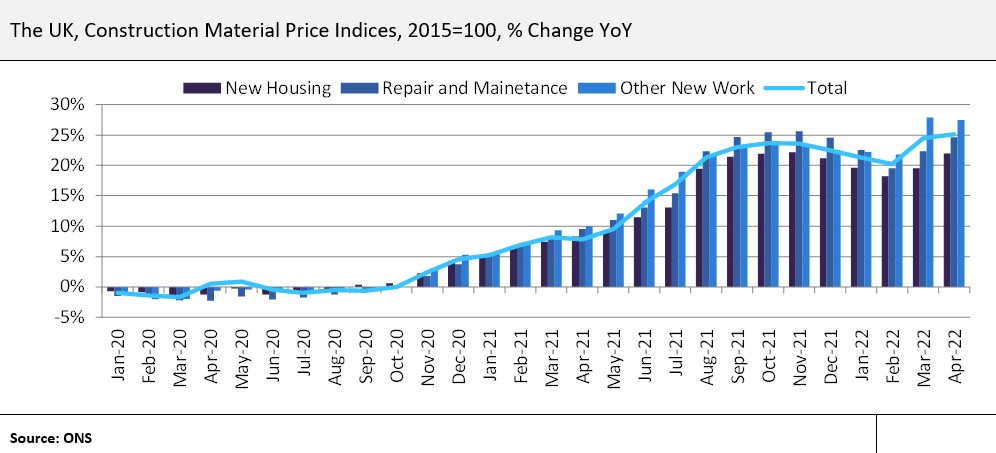

Construction material prices have been rising significantly over the past few quarters, with rising inflation and the Russia-Ukraine crisis expected to add further pressure in 2022. According to the ONS, the construction material price index rose by 25.2% YoY in April 2022 (the latest data available at the time of writing), marking the 11th consecutive double-digit YoY increase since June 2021. Cumulatively, the average construction material price index rose by 22.8% YoY in the first four months of 2022, driven by YoY increases in the prices of new housing (19.8%), repair and maintenance works (22.3%) and other new works (24.9%). Some of the significant construction materials which registered strong YoY growth in prices during the first four months of 2022 include concrete reinforcing bars (steel) (51.2%), blocks, bricks, tiles and flagstones (18.4%), ready-mixed concrete (12.5%), gravel, sand, clays, and kaolin (excluding aggregate levy) (10.7%) and cement (10%).

In late April 2022, the Federation of Master Builders (FMB) – which is the largest trade association in the UK construction industry – reported that small, local builders have been severely affected by the surging inflation and rising material prices. According to the ‘State of Trade Survey’ conducted by the FMB, 98% of builders have experienced material cost increases in Q1 2022, with 83% of them passing these costs onto the customers. The survey also reported that 73% of builders have delayed jobs due to lack of materials, while 55% are delaying work due to a lack of skilled labour. Moreover, 95% of respondents expect material costs to increase in Q2 2022.

Although the industry is expected to remain below the pre-pandemic levels (2019) until 2023, its output in 2022 is projected to remain only 0.7% below the levels recorded in 2019. The industry’s growth in 2022 will be supported by a rise in new orders for construction. According to ONS, the total value of new orders for construction rose by 22.8% YoY in Q1 2022 (the latest data available at the time of writing). New housing orders account for 31.4% of the total value of new construction orders received during that period, followed by private commercial (29.6%), other new infrastructure work (18.7%), other new work excluding infrastructure (10.4%) and private industrial (10%).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData