The construction industry in China is expected to face downside risks in 2025 due to the ongoing trade war between China and the US. Following the imposition of tariffs by US President Donald Trump’s administration on all Chinese imports, demand for Chinese products is expected to decline in the coming period. Given that the US is China’s largest trading partner, the US tariffs would therefore indirectly cause knock-on effects for the Chinese economy as a whole and also adversely affect the beleaguered construction industry, which is already.

Tariff Timeline: Between China and the US

- Pre-2025 – President Donald Trump had taken numerous steps against China during his first term, some of which continued under the Joe Biden administration. In January 2020, the US and China signed the first phase of a trade deal, with China committing to buying an additional $200bn in US goods over two years to reduce the trade deficit. In 2022, the Biden administration retained most of the Trump-era tariffs but extended restrictions on semiconductor sales to China. Furthermore, his administration increased tariffs on Chinese solar cells, electric vehicles, and medical equipment in 2024.

- 4 February 2025 – Donald Trump levied an additional 10% tariff on all goods China exports to the US.

- 10 February 2025 – In response to the US tariffs on Chinese products, China’s Ministry of Finance implemented 15% retaliatory tariffs, including tariffs on US liquefied natural gas, coal, crude oil, and agricultural machinery.

- 5 March 2025 – Trump doubled the tariff rate to 20% on all Chinese imports.

- 10 March 2025 – China implemented another round of retaliatory tariffs on the US agricultural products, including wheat, corn, soybeans, chicken, and pork.

- 12 March 2025 – President Trump announced 25% tariffs on all steel and aluminium imports to the US.

- 26 March 2025 – Trump signed an executive order to impose 25% tariffs on imports of automobiles and automobile parts.

- 2 April 2025 – Labelled “Liberation Day” by Donald Trump, the President implemented some of the toughest tariff policies since the 1930s. His administration introduced reciprocal tariffs, imposing duties equal to half the estimated total tariff and non-tariff barriers that China placed on the US, all as part of an effort to address current trade imbalances. Accordingly, Trump increased tariffs by another 34% on Chinese products – bringing the total to 54%.

- 4 April 2025 – China imposed a retaliatory tariff of 34% on all US-imported goods.

- 9 April 2025 – Trump increased tariffs by another 84% on Chinese products, bringing the total to 104%. China further raised retaliatory tariffs to 84% on all US-imported goods.

- 10 April 2025 – President Trump intensified the ongoing trade war with China by imposing 125% tariffs on Chinese goods. New tariffs reached 145%.

- 11 April 2025 – As the US-China trade war intensified, China retaliated by raising its tariffs on US goods to 125%. The Trump administration announced a temporary exemption for laptops, smartphones, and other consumer electronics from its reciprocal tariffs.

- 13 April 2025 – The Chinese Ministry of Commerce asked to the US to ‘completely cancel’ its reciprocal tariffs on all products.

- 17 April 2025 – The US published a fact sheet indicating that total tariffs on certain goods from China reach up to 245%.

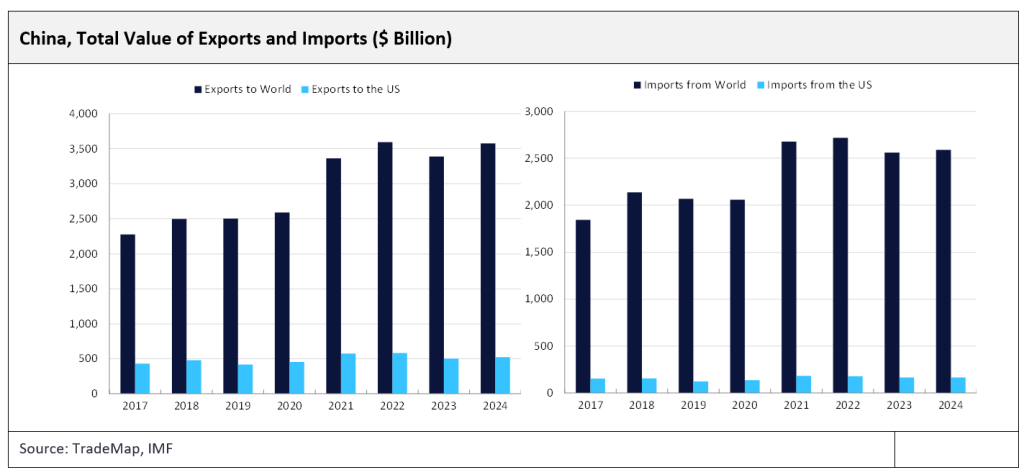

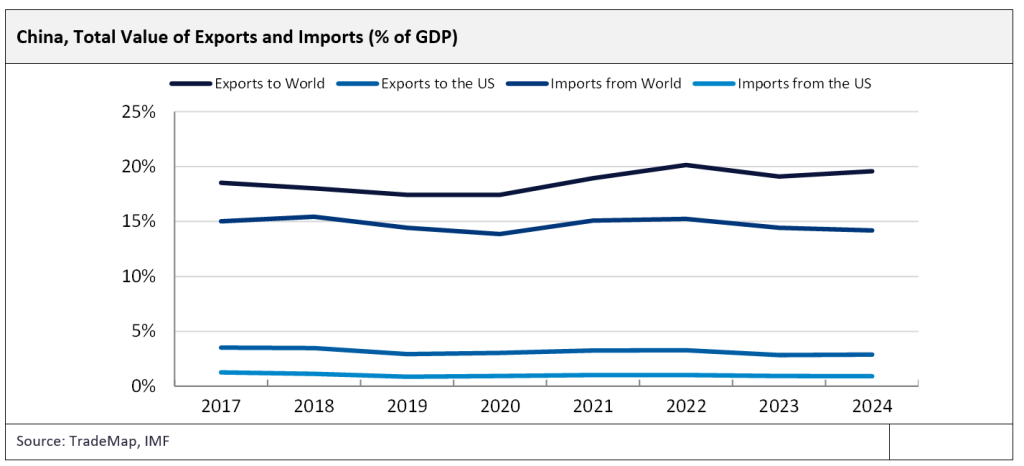

Despite the trade war between China and the US, they remain major trading partners. According to TradeMap (International Trade Centre), China exported goods worth $524.9bn to the US in 2024, reflecting 2.9% of China’s total GDP. However, China imported only $165.2bn worth of US goods last year, accounting for just 0.9% of China’s GDP.

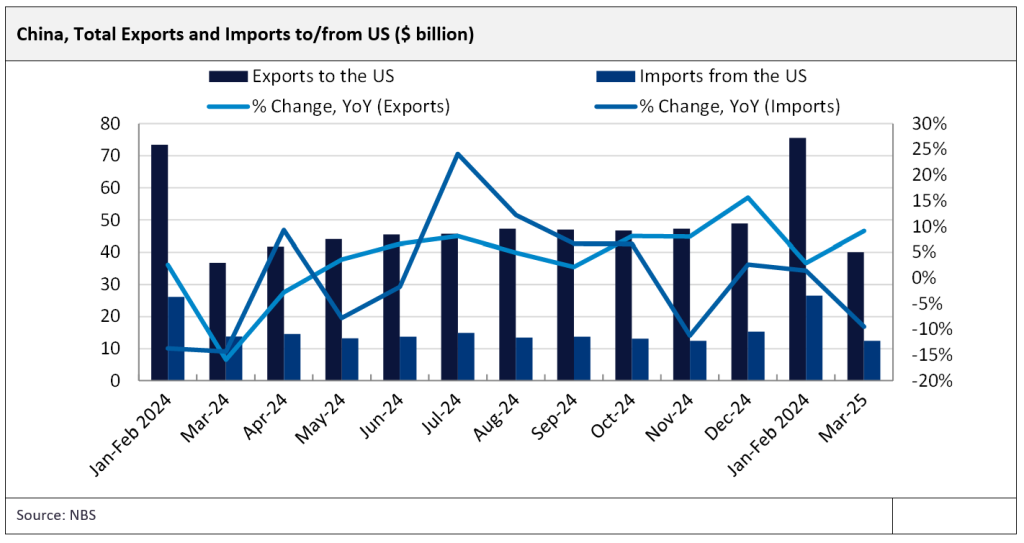

Owing to the increased tariffs, Chinese exports to the US rose by 12% in March 2025, as businesses resorted to frontloading to avoid the impact of the higher duties. According to the latest data released by the National Bureau of Statistics (NBS), the total value of exports to the US, measured in US dollar terms, grew by 9.1% year-on-year (YOY) in March 2025, following YOY growth of 2.9% during January-February 2025. In contrast, the total value of imports from the US declined by 9.5% YOY in March 2025, after a modest YOY growth of 1.4% during January-February 2025.

The Chinese economy is expected to be hit severely due to the tariff war. The impact of a 145% tariff rate, if permanently imposed, could drive Chinese exports to the US close to zero. The tariff hikes are also expected to place significant pressure on the Chinese labour market. Already grappling with a property market slump, weak domestic spending, and high youth unemployment, the Chinese economy faces heightened risks. Goldman Sachs Group, the American multinational investment bank and financial services company, reduced its growth forecasts for China on 10 April 2025. The country’s GDP is now expected to grow by 4% in real terms in 2025 and 3.5% in 2026, down from earlier forecasts of 4.5% and 4%, respectively. Furthermore, Fitch, the global credit ratings agency, downgraded China’s long-term foreign currency credit rating on 3 April 2025, to ‘A’ from ‘A+’, citing weak public finances and rising debt levels. To mitigate the impact of tariffs, China is likely to focus on domestic stimulus, strengthening trade ties within Asia, and maintaining a strong yuan to shift inflationary pressure onto the US. Additional policy support is also expected to be introduced. Goldman Sachs now forecasts that Chinese authorities will cut the policy rate by 60 basis points in 2025, up from previous expectations of 40 basis points.

To ease pressure from the ongoing US-China trade war, on 10 April 2025, Chinese electronics component manufacturers announced plans to offer discounts of up to 5% to Indian companies as part of new sourcing contract negotiations. On 11 April 2025, China extended an invitation to strengthen ties with the European Union (EU) to defend globalisation and push back against what it called US “bullying” tariffs. That same day, China signed two agricultural trade protocols with Spain to deepen economic ties. Additionally, China aims to expand trade with countries hardest hit by Trump’s tariffs. On 15 April 2025, China and Vietnam signed multiple cooperation agreements to strengthen trade ties, including efforts to enhance supply chains.

Impact on construction industry

The proposed tariff schedule introduced by the Trump administration has heightened uncertainty for China’s construction industry, contributing to stagnation in labour markets and weakening aggregate demand. High tariffs on all steel and aluminium products are expected to affect the sector significantly. As steel and aluminium are critical construction materials, the rising cost of these inputs is likely to impact construction output in the short to medium term. Elevated material prices are expected to be passed on to consumers, inflating construction costs and reducing the affordability of new builds. In addition to existing weaknesses in industrial construction activity, the intensifying US-China trade war is expected to dampen investor confidence, potentially leading to reduced investment in the construction industry in the near term.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- Within the construction industry, the industrial construction sector is expected to bear the brunt of the tariff war, as companies grow wary of investing in China and consider alternative destinations with more favourable trade conditions with the US.

- The residential construction sector, already under strain, is also likely to suffer. Lower employment and declining consumer confidence may further exacerbate the sector’s weakness.

Navigate the shifting tariff landscape with real-time data and market-leading analysis.

Request a free demo for GlobalData’s Strategic Intelligence here.