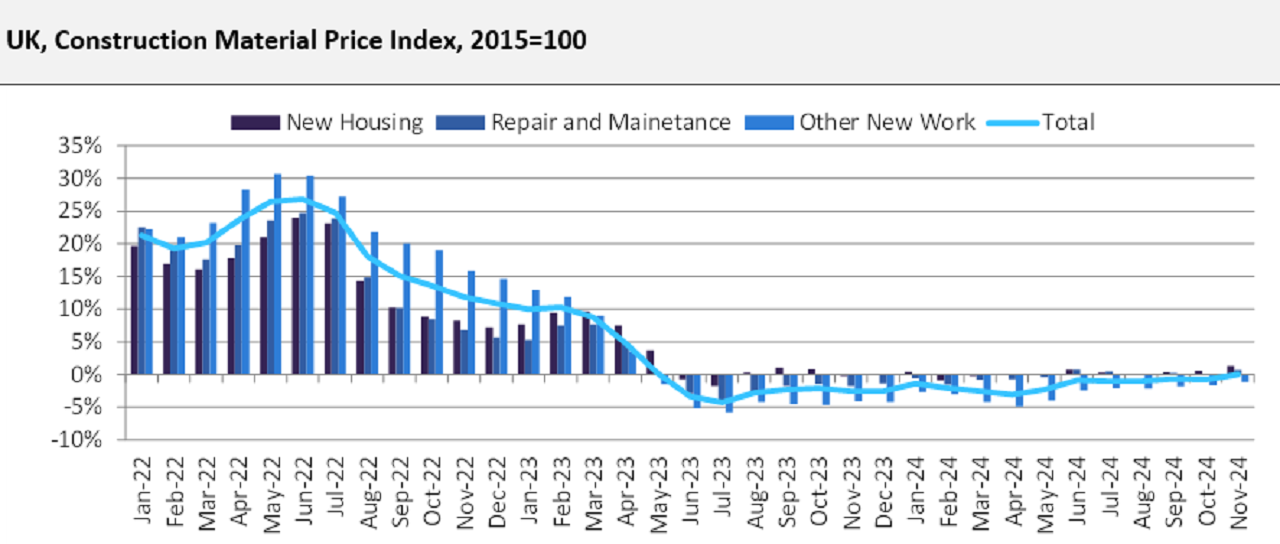

Following an estimated marginal contraction of 0.7% in real terms in 2024, leading data and analytics company GlobalData expects the construction industry to record a marginal growth of 0.5% in 2025, supported by a recovery in the construction order levels and new investments in the commercial and infrastructure works coupled with falling construction costs and falling interest rates. According to the Office for National Statistics (ONS), the average construction cost fell by 1.5% year on year (YoY) in the first nine months of 2025, which is down from an annual marginal growth of 0.9% in 2023. By segments, the average costs of other new work declined by 2.8% YoY and repair and maintenance costs by 0.2% YoY outweighing the marginal growth of 0.2% YoY for costs of new housing during the same period of 2024. Furthermore, the Bank of England reduced the interest rate two times from a high of 5.25% in July 2024 to reach 4.75% in November 2024 before keeping constant in December 2024. Recently, the Bank of England’s Monetary Policy Committee reduced the interest rate to 4.5% in February 2025, with it expecting the rate to gradually decline to 4.25% by the end of 2025.

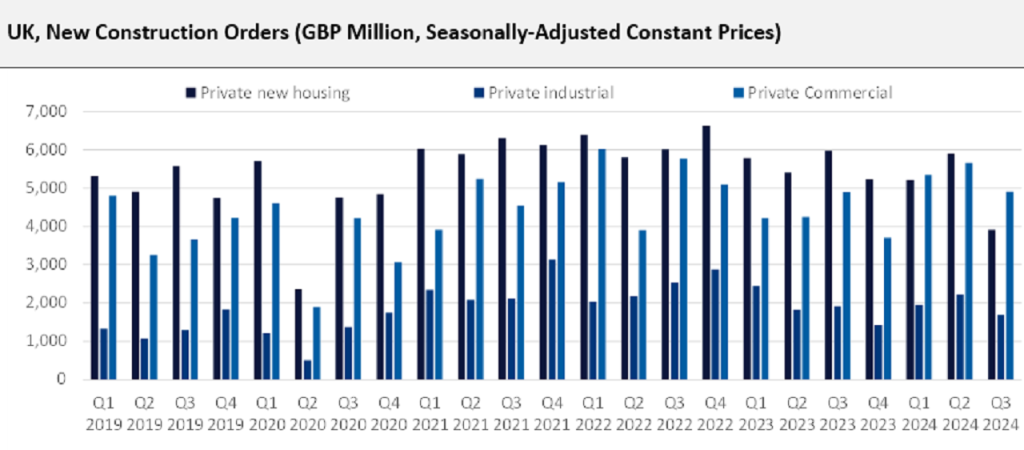

The construction industry in 2025 will also be supported by a recovery in construction orders. According to the ONS, the value of construction orders for new construction works grew by 6.5% YoY in the nine months of 2024. Similarly, construction orders for infrastructure orders and private commercial orders grew by 21.3% and 19.1%, respectively, during the same period.

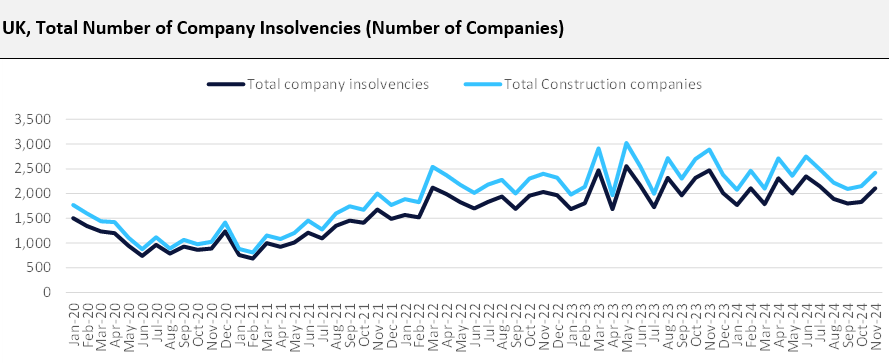

The construction industry’s weakness in 2025 is also attributed to a decline in construction insolvencies. According to the ONS, total insolvencies decreased by 4.6% YoY in the first 11 months of 2024, totalling 22,094 companies. Within this, construction companies reporting insolvencies declined by 7.1% YoY, totalling 3,735 companies. Construction insolvencies account for 16.9% of total company insolvencies. By construction segment, building construction and civil engineering company bankruptcy decreased by 8.1% YoY and 1.5% YoY, respectively, during the first 11 months of 2024.

Despite these positive sentiments, the construction industry looks gloomy in the short to medium term owing to a sluggishness in the residential sector amid falling residential housing construction orders and elevated construction costs for the construction of new houses. According to the ONS, the value of construction orders for new public and private housing work fell by 23.5% YoY and 12.5% YoY respectively in the first nine months of 2024. According to the Confederation of British Industry (CBI), 71% of UK businesses have experienced labour shortages in 2023. Later, in September 2024, the CBI reported that the labour shortage problem could last until the end of 2026. With the current high demand for skilled personnel in the UK construction sector, an additional 225,000 workers per year will be required by 2027 to meet the growing construction demand, according to the Construction Industry Training Board. All of this is expected to adversely affect both the housing market and business confidence. The residential construction sector, which accounts for 44.5% of total construction output in 2024, is forecasted to decline by 5.6% in 2025 thereby keeping the overall construction industry constraint. However, the residential sector is expected to recover from the second half of 2025 in line with the government’s aim of constructing 180,000 affordable houses in the country at an investment of £11.5bn ($14.2bn) by 2026. Furthermore, the construction industry will also be supported by investments in renewable energy projects in line with the country’s aim to generate 70% of electricity from renewable energy sources by 2030 and reduce carbon emissions by 80% compared to 1990 levels by 2035.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData