- The appointment of Gabriel Galipolo – the new president of Banco Central Do Brasil – suggests further Selic rate hikes, contradictory to President Lula’s budget cuts for FY25.

- Elevated building material prices hang in the balance, contingent on looming US tariffs.

- Constructors continue to show resilience, subtlety growing in confidence across 2024, according to the CNI/CBIC Construction Industry Survey.

Despite interest rate hikes in September, November, and December, Brazil achieved construction growth of 3% in 2024, led by 4.1% in Energy and Utilities construction. Furthermore, Gabriel Galipolo – the new president of Banco Central Do Brasil – has double-downed on Brazil’s hawkish fiscal outlook, raising rates by 100bps on 29 January to 13.25%. On one hand, tightened public funding will continue to limit the feasibility of new construction starts while higher rates help to combat inflationary risk, signalling greater confidence to investors. Moreover, to add to fiscal complexities, Brazil’s construction market is exposed to potential third-party residual effects from pending US tariffs on Mexico. Hence, Brazil’s construction market outlook remains complex. Nevertheless, leading data and analytics company GlobalData remains positive on Brazil’s 2025 construction prospects, forecasting subdued growth of 2.5%.

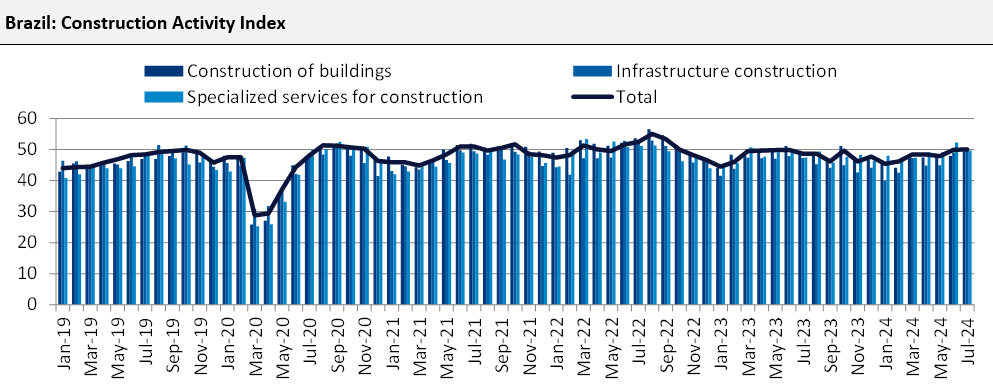

Construction activity

According to the latest Construction Industry Survey – published by the National CNI with the support of the CBIC – the average construction activity index grew marginally by 0.9% year on year (YoY) in the first 11 months of 2024. By segment, services for construction and infrastructure construction grew by 2.6% YoY and 2.8% YoY during the same period of 2024, respectively. However, the indices remain below 50, indicating a decline in activity (values above 50 would indicate an increase in activity). Furthermore, the average activity index of the construction of buildings fell 1.5% during the same period of 2024. This sluggishness in the activities is due to ongoing economic headwinds such as elevated inflationary pressure, leading to a tightening of monetary policy and weak investor sentiment.

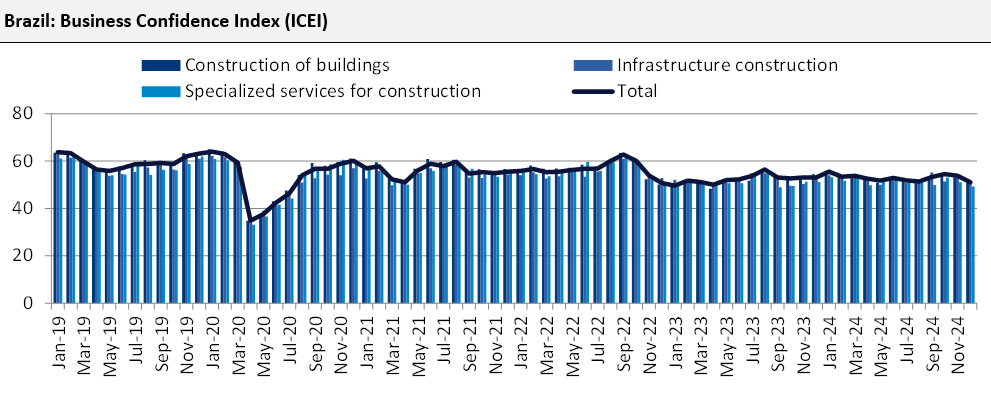

Construction sentiment

According to the National Industry Confederation (CNI) and Brazilian Chamber for the Construction Industry (CBIC), Brazil’s business confidence indicator (ICEI) for its construction sector has consistently remained strong, averaging 53 across 2024 (same scale as above); marking a 1.1% annual increase compared with 2023. Increased ICEI stems from the recommencement of stunted projects amid bearish interest rate hikes and climate shocks, particularly.

By segment, confidence increased from 52.1 to 52.8 for the construction of buildings, 51.8 to 52.4 for infrastructure construction, and from 51.1 to 51.5 for specialised services for construction, over the same period.

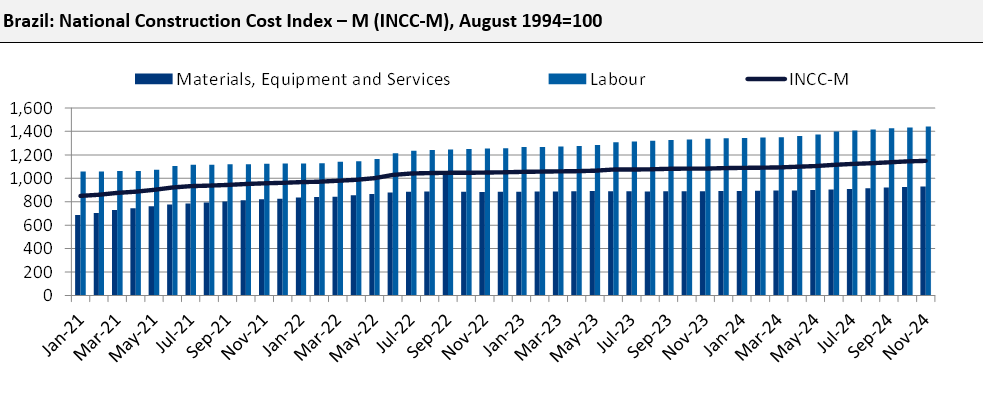

Construction costs

According to the FGV/IBRE, the average National Construction Cost Index – M rose by 4.3% YoY in the first 11 months of 2024, owing to a 7.1% YoY rise in the prices of labour and a 2.2% YoY rise in the prices of materials, equipment, and services during the same period of 2024. This increase in the price of labour can be attributed tothe Brazilian government providing significant benefits to maintain productivity as many companies face a shortage of qualified labour. According to the CNI and CBIC, the average index of the evolution of the number of employees declined by 1.6% YoY in the first 11 months of 2024, reaching 48 from 48.7 in the same period of 2023.

In addition to these challenges, the Central Bank of Brazil, Banco Central has raised its consumer price inflation forecasts from 4.5% for 2025 as forecasted in December 2024 to 5.2% for 2025 in January 2025, well above its target of 3%. As a result, it raised the Selic rate by 100 basis points to reach 13.25%, marking the fourth consecutive increase since August 2024. The sharp increases in the Selic rate weighed on the construction industry output towards the end of 2024 and are expected to continue in 2025.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe regulatory outlook

Red tape associated with Brazil’s constriction prospects continues to demand high direct and indirect costs of doing business – commonly referred to locally as the “Custo Brasil” or “Brazil Cost.” This includes a complicated tax system, especially for imported goods, which requires importers to often face double the tax burden. Although Brazil’s lower house and senate approved the new tax reform in July 2023 and November 2023 respectively, with an aim to simplify the complex tax system, the implementation is scheduled to commence in 2026 and will be proposed by 2033. Furthermore, the persistence of ineffective intellectual property protection and enforcement, different regional regulations, and a non-transparent public procurement process exacerbate the issue. In addition to this, US President Trump’s looming tariffs are suspected to tamper with Brazilian construction output via increased trade embargoes. In late January 2025, Trump vowed to impose tariffs on Brazilian products prioritizing American interests if the BRICS nations adopt a new reserve currency instead of using the US dollar. If the tariffs are imposed, this will lead to reduced US dollar inflows in Brazil, impacting foreign exchange markets. Therefore, these challenges create additional barriers for market participants which can keep the construction industry and employment levels sluggish in the coming quarters.