In January 2024, Thai Prime Minister Srettha Thavisin announced that the cabinet had approved his government’s Fiscal Year (FY) 2024 (October 2023 to September 2024) budget at its first reading. The budget, worth Bt3.5trn ($101.2bn), includes an allocation of Bt2.5trn for fixed expenditure, Bt717bn for investment, and Bt118bn each for the repayment of loans, and the reimbursement of treasury reserves. Some of the major allocations include Bt328bn to the Ministry of Education, Bt198bn to the Ministry of Defense, and Bt183bn to the Ministry of Transport. Although the budget was scheduled to take effect in October 2023, the prolonged political deadlock following the May 2023 elections has delayed the process.

The budget is allocated to six areas based on the 20-year National Strategy – this includes an allocation of Bt951bn for social equality; Bt734bn for public administration; Bt592bn for competitiveness; Bt561bn for human security; Bt391bn for national security, and Bt247bn for sustainability. Approximately 25% of the budget has been allocated towards addressing social issues such as the aging population, enhancing education, and expanding universal healthcare. Further allocations include the allocation of approximately 11.3% of the budget towards energy security, digital economy, and future industries such as electric vehicles (EVs).

The budget for the second half of FY 2024 includes a 9.3% increase in spending over the previous year, and a 0.3% fall in the budget deficit, to Bt693bn. The higher spending in this year’s budget is needed to revive the country’s economy, which shrank by 0.6% quarter-on-quarter (QoQ) (in seasonally adjusted terms) in Q4 2023, the sharpest fall since Q4 2022. A decline in fixed investment, partly due to the delay to the budget, and weakness in private consumption and exports contributed to the slowing of economic growth in Q4 2023. Prime Minister Srettha expects that exports, private consumption, investment, and the ongoing recovery in the tourism sector will contribute to an estimated GDP growth of between 2.7%-3.7% in 2024. The Thai cabinet approved an additional Bt560bn in new borrowing for FY 2024, in February 2024, on top of the Bt194bn previously approved; this brings the total new borrowing in FY 2024 to Bt754bn. The new borrowing will mainly be used to finance the budget deficit, and is a part of the revised debt management plan, which includes the restructuring of existing debt of Bt2trn and debt repayments of approximately Bt400bn.

In late February 2024, a government spokesperson reported that Thailand’s Bt3.5trn Budget will be ready for use by early April, with the budget act likely to be passed into law as early as 3 April 2024. The budget plan will go to parliament for the second and third readings on 20-21 March, before seeking approval from the Senate and the King. The Thai Ministry of Finance has outlined measures to accelerate the disbursement of the FY 2024 Budget, which requires contracts for new investment projects to be signed by July 2024. Upon approval of the budget, the Comptroller-General’s Department will disburse the allocated budgetary funding to provincial finance offices across the country within five days to fund their planned spending.

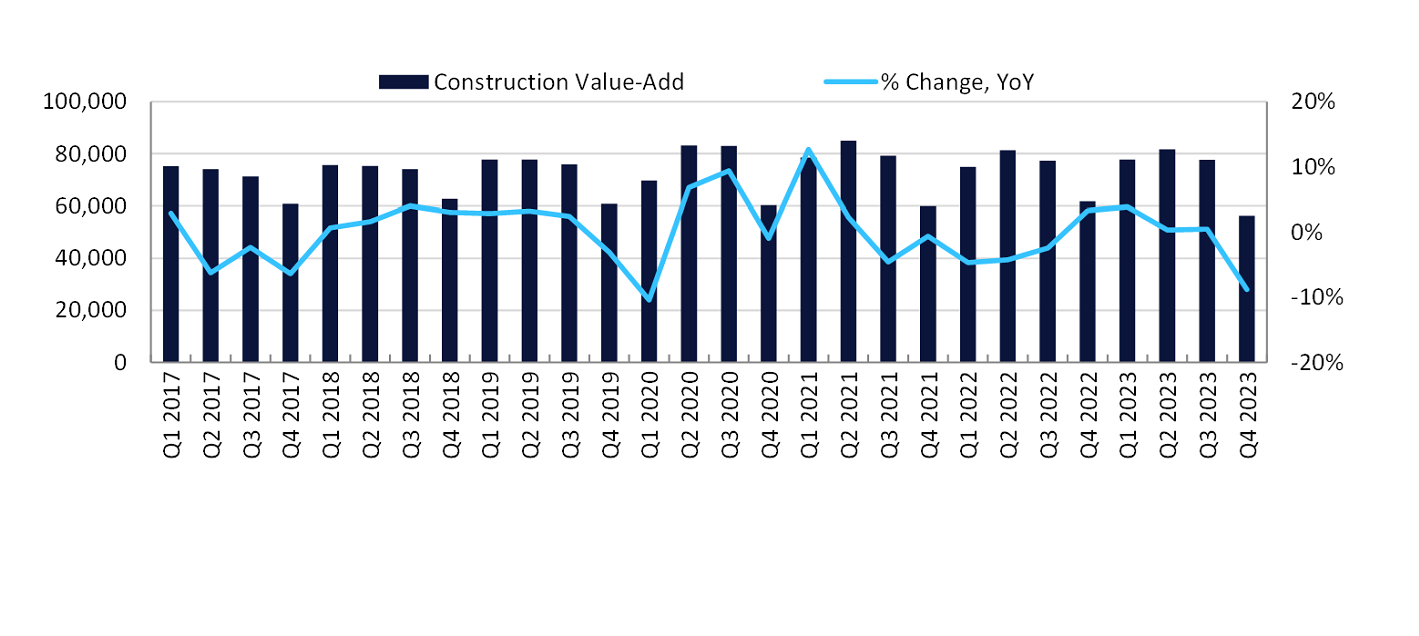

According to the National Economic and Social Development Council (NESDC), the construction industry’s value add plummeted by 8.8% YOY in the final quarter of 2023, the worst reading since Q2 2020 and the first YOY fall since Q4 2022; this was preceded by marginal YOY growths of 0.5% in Q3 and 0.3% in Q2 2023. The sharp fall in Q4 2023 is due to a drop in public construction, particularly general government construction; in contrast, private construction continued to expand for its fifth consecutive quarter in Q4 2023. The sharp decline in Q4 2023, and weak growth in Q3 and Q2 2023 have resulted in the construction industry’s value-add registering an annual decline of 0.6% in 2023.

See Also:

GlobalData does, however, expect the construction industry to rebound this year and register an annual growth of 1.7%, supported by an improvement in government spending. The construction industry is expected to register an average annual growth rate of 4.2% from 2025 to 2028, supported by government investment in the transport and energy sectors. In mid-February 2024, the Government of Thailand announced it plans to invest Bt667.4bn to develop 150 transport infrastructure projects between 2024 and 2025. Tenders for four motorway sections, with an estimated combined cost of Bt141.4bn, are scheduled to open in late 2024. Moreover, in the same month, the government announced that it plans public-private partnership (PPP) investment projects worth Bt1.19trn to 2027. The revised amount is slightly higher than the Bt1.17trn previously approved, with the government aiming to attract more private companies to invest in government projects.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData